An Introduction to crypto trading bots

It is no secret that in traditional markets like Forex or stocks a large portion of these trades are being executed by trading bots managed by institutional, day traders, and other entities. These high-frequency trading techniques have changed the landscape of fintech and traders and companies alike are constantly fighting to maintain their edge. With the explosion of Bitcoin in late 2017 this cutting-edge method of trading has grown rapidly on cryptocurrency exchanges. Digital asset exchanges are more plentiful and rarely shutdown as compared to their traditional counterparts. The new age day trader must adapt and learn to use these advanced forms of trade automation.

Individuals, organizations, and companies are all looking for creative ways to improve profit margins and efficiency. One way of doing this is by automating manual trading strategies that have historically proven to be profitable. In its most basic form, the platforms used for most Bitcoin trading bots allow a user to configure variables that exist inside the scripts, which are typically thresholds for values generated by technical indicators. Other features found in trading bots might include features like copy trading, external signals, scripting languages, charting, and more.

In our review guide, we will take a look at our top 5 Bitcoin trading bots for 2020, features we like (or don’t), supported exchanges, and other features necessary for a day trader to grow new skills with trade automation.

Frequently asked questions

As previously mentioned automated trading has been around for quite some time and goes by several different names, including; algo-trading, high-frequency trading, system trading, mechanical trading, and so on. Automated crypto trading allows traders to recreate manual trading strategies at scale. Once a trader has settled on one or more trading strategies they can input those variables into a framework that allows computers to trade on their behalf.

It’s estimated that around 80% of all US stock exchange trading originates from automated trading systems like HaasOnline Trade Server. If you were trading on cryptocurrency exchanges prior to 2018 it’s more likely than not that you were trading against trading strategies deployed from our automated trading software as it were the only Bitcoin trading bot that was widely available to the public.

These automated trading systems vary in complexity and will generate signals from a single technical indicator or use several combined with other complex rulesets that can enable or disabled new trading strategies based on market movement. It’s wise to choose a platform where you are a little out of your depth and can learn to leverage more complex trading skills.

Cryptocurrency trading bots are a byproduct of trade automation software, which execute manual trading strategies and are typically integrated into one or more cryptocurrency exchanges. Trading bots have existed in the markets like Forex and have proven themselves time and time again. With cryptocurrency these trading bots are no different and are able to take advantage of markets 24/7 with an efficiency that cannot be matched by manual trading.

These trading bots vary in price, complexity, and expandability. We’ve taken the time to list beginner friendly, intermediate, and advanced crypto trading products (like us). There are also free and open source options available for the more determined and technically savvy traders.

Crypto trading bots are able to execute buy and sell orders as defined by their specific strategy or script. Typically these orders follow proven trading strategies that have existed successfully on traditional trading market and can include Ping Pong, Scalping, Arbitrage, etc. Once the trading bot has determined the buy and sell orders, they are then executed on the exchange’s API resulting in high-frequency automated trading.

Depending on which product you’re using, a trade bot’s functionality can be as rudimentary as setting limit orders or something more complex like performing triangular arbitrage. A trade bot will use a combination of technical indicators and other signals to calculate buy or sell orders for your automated strategy.

Once you’ve properly configured a trading bot with your desired strategy it is typically vetted by using a technique called backtesting. This uses historicals exchange data to determine if your trading strategy has the potential to be profitable or not. Traders also use another method called paper trading or simulated trading which uses real time exchange data. Backtesting and simulation both have their flaws, but generally it’s a good indicator of what to expect from your trading bot.

What to consider when choosing your trading platform

Reliability

This is a priority for any serious developer of trade automation software or products. As a trader you’re trusting third-party software to not only do what was advertised, but also reliably. The majority of the companies listed have a track record of being able to reliably execute proven trading strategies on cryptocurrency exchanges. Look to make sure the companies are developing a product that continually receives updates, new features, and exchange integrations.

Transparency

It should be no surprise to you that there are people and companies out there willing to do unscrupulous things to steal from you at any cost. Companies like Bitconnect had all the signs of a ponzi-scheme, however a lot of people were still lured into investing in the project and ultimately got rekt. You should be able to identify key people from the company and determine whether or not they’re creating trustworthy products for the long-term.

Security

There’s two options when it comes to picking trade automation and that’s on-premise or cloud-based. With each option comes their own set of unique security challenges. Do you trust that the infrastructure housing all your trading data is secure and actively combats against bad actors? Do you have the ability to manage your own virtual private server and implement safeguards to prevent unauthorized access?

Profitability

This seems like a no-brainer, however you still see it all the time with people posting about how they’re barely breaking even or from influencers saying they just closed a 9001% profitable trade. Be skeptical of companies or individuals claiming results that seem too good to be true, as these often end poorly. The number one rule for trading is to be patient with your trading methodology and refine it over time.

TLDR: Top 2 Choices

Looking for our top 2 crypto trading bots? Here’s our top 2 choices for both cloud and self-hosted:

| HaasOnline | Cryptohopper | |

|---|---|---|

| ||

| Supported Exchanges | 23 | 11 |

| Monthly Price | ~0.03 BTC | ~$17 USD |

| Style | Self-hosted | Cloud |

| Backtesting & Simulation | ✔ | ✔ |

| Scripting Language | ✔ | — |

| Visual Algo Designer | ✔ | — |

| Advanced Order Types | ✔ | — |

| Marketplace & External Signals | — | ✔ |

Top 5 Bitcoin Trading Bots of 2020

There’s a growing number of beginner friendly crypto trading bot platforms and these will not be considered for our list. All the platforms mentioned below have a proven track record, offer reliable solutions for automated trading, and engage in truthful advertising practices.

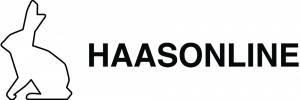

CryptoHopper

Cryptohopper is another great Dutch technology company that provides a web-based platform for automated trading. They launched in the middle of 2017 and have quickly risen to one of the most reputable Bitcoin trading bot platforms that is aimed towards beginners and intermediate traders.

Supported Exchanges

- Binance

- Binance.US

- Bitfinex

- Bittrex

- Bitvavo

- Coinbase Pro

- Huobi

- Kraken

- KuCoin

- OKEx

- Poloniex

Backtesting & Simulation

Cryptohopper does offer support for backtesting using historical exchange data. However, the shortest interval candles can go are 5 minutes. There’s also no backtesting or paper trading support for advanced trading like arbitraging strategies.

Scripting Language

There’s no support for developing automated trading scripts using a scripting language like HaasScript. There is a marketplace which does contain a selection of paid and free strategies as well as signals, however there is no way to examine hidden configurations.

Visual Algo Designer

They offer a rudimentary trading script designer that allows you to drag-and-drop technical indicators with buy or sell signals when creating your automated trading strategy.

Advanced Order Types

According to their documentation it seems, Cryptohopper, strategies will only allow you to use native exchange order types like market or limit orders with no ability to create your own.

Marketplace & External Signals

Cryptohopper offers a public marketplace for users to buy and download free templates, strategies, and rent signals. We feel this is where their service really shines and their community really loves.

Pros

- Cloud-based for easy setup

- Free trial

- Sleek responsive user interface

Cons

- Low quality external signals

- Lack of support for advanced trading strategies

GunBot by Gunthy

GunBot is another cryptocurrency trading software option that is designed to be installed on a local machine or virtual private server for maximum reliability and performance.

Supported exchanges

- Binance

- Bitfinex

- BitMEX

- Bittrex

- CEX

- Cobinhood

- Huobi

- IDAX

- Kraken

- KuCoin

- KuMex

- Poloniex

Backtesting & Simulation

To backtest your strategies with Gunbot you are required to buy their backtesting add-on, which leverages a third-party infrastructure. There is currently no native support for paper trading or simulated trading using custom strategies.

Scripting Language

There doesn’t appear to be any form of open source code or configs available on their demo servers and most of their crypto trading bots rely purely on technical indicators for buy and sell signal generation.

Visual Algo Designer

There was no visual algo designer or text-based editors available to view, modify, or create new automated crypto trading scripts.

Advanced Order Types

GunBot does support native order types from crypto exchange, but also allows users to leverage several predefined custom order types. Custom order types allow traders to create more refined crypto trading bots.

External Signals & Marketplace

GunBot has limited support for external signals. However, users are able to use Telegram and TradingView alerts as buy and sell signals. There is also no central marketplace for users to buy, share, or rent crypto trading scripts.

Pros

- Great for beginner to intermediate traders

- Sleek user interface

Cons

- Restricted exchange usage

- No native backtesting or paper trading engine

HaasOnline Trade Server by HaasOnline

We wouldn’t consider this list complete without mentioning the hard work our team has put into HaasOnline over the past six years. Our flagship product, HaasOnline Trade Server, allows traders to deploy highly complex crypto trading bots that will execute automated trading strategies across dozens of exchanges with the precision and reliability our users have come to rely on.

Supported Exchanges

- Binance

- Binance Futures

- Binance.US

- Bitfinex

- BitMEX

- Bitpanda GE

- Bitstamp

- Bittrex

- ByBit

- CEX.IO

- Coinbase Pro

- Deribit

- Gemini

- HitBTC

- Huobi

- Ionomy

- Kraken

- Kraken Futures

- KuCoin

- OKCoin

- OKEx

- OKEx Futures

- Poloniex

Backtesting & Simulation

Compared to other platforms, our backtesting and simulated trading engines are unmatched. We offer multiple methods of determining the closing prices with detailed reporting. Use up-to 56 weeks of historical market data on one minute candles when backtesting. Traders can also use our accurate real-time exchange data when paper trading or simulating their trading bot strategies to get a feel how trading strategies will work in live scenarios.

Scripting Language

We’ve developed the world’s most advanced scripting language built specifically for creating high-quality automated trading strategies to be used with cryptocurrencies and crypto trading bots. HaasScript allows a trader to control every aspect of their automated trading strategy from complex calculations, market data, external wallets, memory management, and much more. Definitely too many options to list in this article.

Visual & Text-based Crypto Algo Editors

While using HaasScript powered trading bots you can choose to create these crypto algos using our brand new drag-and-drop visual designer that allows you to use over 600 visual blocks or get back to basics with our updated text-based IDE with intellisense.

Advanced Order Types

Our platform offers traders the ability to modify and choose from robust selection of native order types like limit and market orders. However, with HaasOnline you can build your own advanced order types that the exchange does not natively support (i.e. 25% market order) and your HaasBots will execute them as an intermediary.

External Signals & Marketplace

HaasOnline Trade Server can receive external signals from third-party sources like TradingView, Telegram, and Discord. There’s currently no support for external signals generated from public marketplaces. It should be noted that development for copy trading and a public marketplace is slated for release in the future.

Pros

- Great for intermediate and advanced traders

- Highly configurable trade automation

- Large selection of exchanges

Cons

- Difficult platform for beginners

- No marketplace and limited external signals

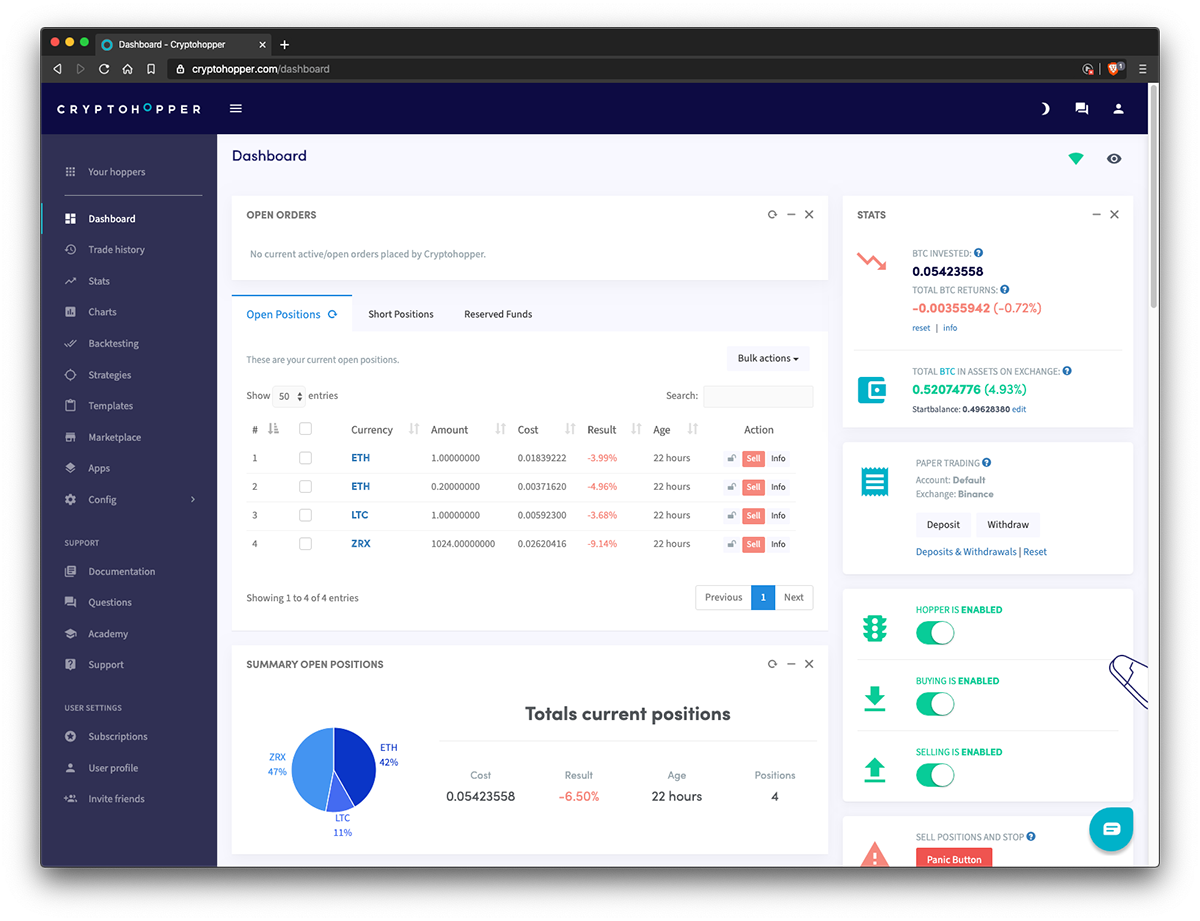

Profit Trailer

ProfitTrailer is another example of a good automated trading platform for beginners to learn on, but if you’re a growing trader you will likely outgrow this platforms features quickly.

Supported Exchanges

- Binance

- Bittrex

- BitMEX

- Huobi

- KuCoin

- Poloniex

Backtesting & Simulation

Profit Trailer does offer backtesting, however it should be noted that the details on the methods used to generate backtest results cannot be found in the documentation or through demo server settings. You can also purchase an addon, which will give you paper trading functionality for your crypto trading bots.

Scripting Language

Profit Trailer does not offer any form of open source scripting language to design and develop trading strategies or technical indicators. The closest thing they offer are configuration files that can be shared or viewed.

Visual Algo Designer

There is no visual designer or text-based editor found on this automated trading platform as it’s been designed for traders who are looking to only use Profit Trailer’s predefined trading strategies and configuration files.

Advanced Order Types

It appears as though Profit Trailer only supports a limited number of native order types for use with their crypto trading bots.

External Signals & Marketplace

Profit Trailer does have limited support for external trading signals from a few select providers. They also provide a public statistics page that shows historical data related to the signal provider. There does not appear to be a public marketplace for traders to exchange or share free or paid crypto trading strategies.

Pros

- Great for beginners

- Simple user interface

- Easy to use dollar cost averaging

Cons

- Limited charting inside app

- Elementary trading bot configuration

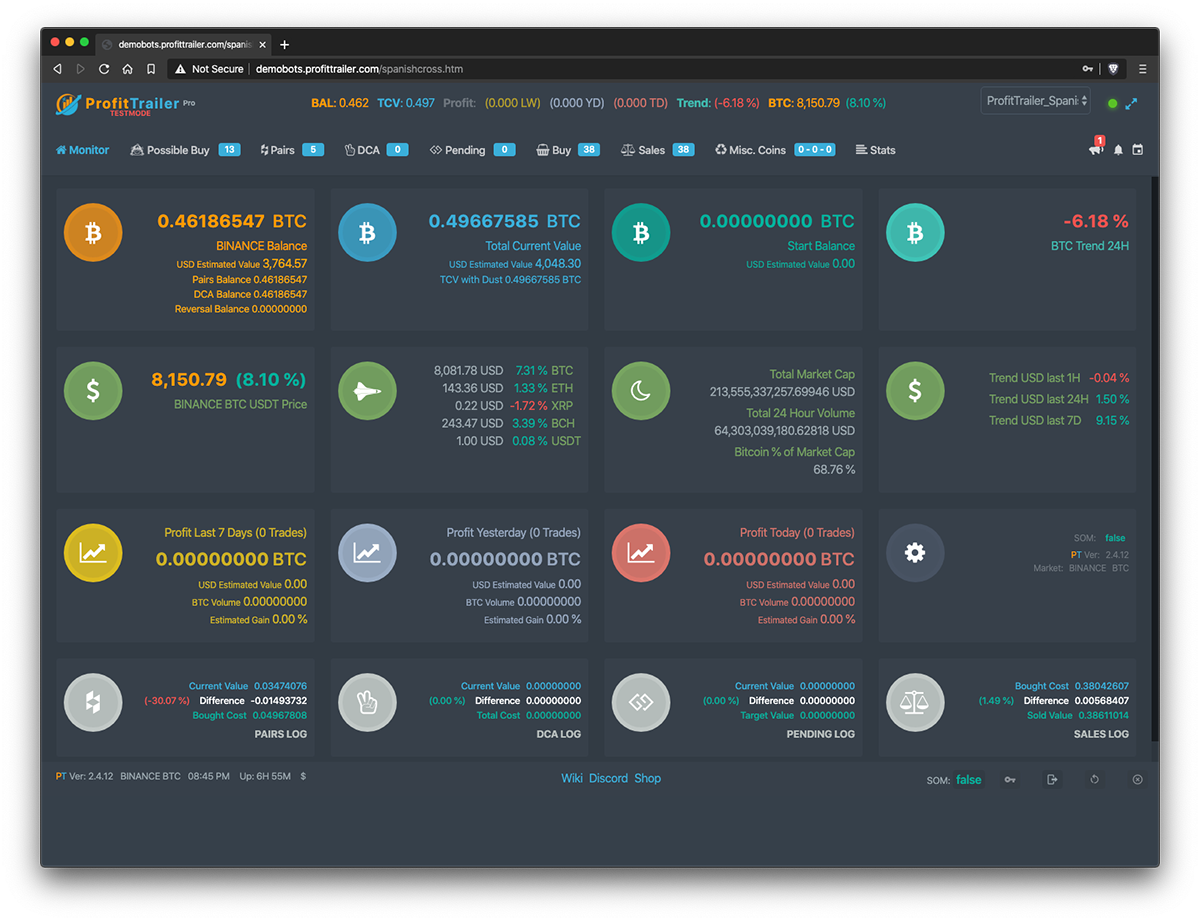

CryptoTrader

CryptoTrader has been around for quite some time and offers users a cloud-based platform that is closely knit with their trading community and ecosystem.

Supported Exchanges

- Binance

- Bitfinex

- Bitstamp

- Bittrex

- Coinbase Pro

- Huobi

- Kraken

- OKCoin

- Poloniex

Backtesting & Simulation

CryptoTrader does support simple backtesting with options for intervals down to one minute for all their supported exchanges. They also include basic options like account balance and trading fees. They do not support simulated paper trading from the web interface.

Scripting Language

You can use various wrappers and frameworks developed by the community that interact with CryptoTrader’s API. Their scripting language and syntax appear to be based on CoffeeScript. However, finding in-depth documentation on CryptoTraders API might be an issue for some developers requiring additional explanation.

Visual Algo Designer

It does not look like CryptoTrader offers any visual editors on their platform. There’s only access to an archaic text-based editor in the backtesting section, which some minimalistic traders might enjoy.

Advanced Order Types

Since you are required to develop your strategies by hand, it’s possible you could include your own order type functions. There are no predefined web-based options to create a crypto trading bot with any particular trading strategy.

External Signals & Marketplace

CryptoTrader has an established marketplace full of community generated scripts for download or rent. Browsing for specific strategies or by rank seems to be limited, but community support is there.

Pros

- Cloud-based

- Strategies marketplace

Cons

- Limited company background and team information

- Restrictive trading limits

- Not available for United States customers

- Required to fund account

Open Source (Gekko & Zenbot)

These free crypto trading bots are open source and ready for you to transform them into working automated trading applications.

Pros

- Free

- Open source

Cons

- Inconsistent updates to codebase

- Programming knowledge required

- No dedicated support

Advantages of using automated crypto trading

Improved Efficiency

Crypto trading bots are able to analyze multiple cryptocurrency exchanges, with dozens of crypto pairs, simultaneously, and execute trades based off those generated signals with speed and precision.

Using brain power with manual trading for this type of scaled trading is not efficient and can lead to more missed opportunities due to the lack of ability to execute the desired trades. This is why trading bots are a far more efficient way to trade with scale.

Increased Speed

It’s well known that computers are more efficient at producing a result for complex calculations in real-time. This is something that we cannot replicate as humans by placing manual buy or sell orders on exchanges from the result of processing dozens of signals at once.

While trading cryptocurrency, the markets never sleep and they’re extremely volatile making every second matter, especially since there’s much larger delays in executing orders than with traditional markets.

Reduce Emotional Trading

Using automated trading system can help to minimize or eliminate emotional trading. This is because you’re trusting your trade bots to execute known repeatable strategies that have track records of profitability in specific market conditions.

Trades are only executed once the technical indicator signals have been processed and meet or exceed the threshold, instead of relying on emotions to trigger buy or sells.

Create Trading Systems

Any profitable trader will agree that you need to stick with a crypto trading strategy that has higher odds of winning than losing. With automated bot trading you are given the tools to create trading strategies that win more often in your desired market conditions. Some platforms, like HaasOnline, will allow your Bitcoin trade bots to manage multiple strategies, so as the markets change so can your trading styles.

Trading 24/7

Using crypto trading bots allows traders to monitor markets and deploy automated trading strategies while being absent from the trading terminal. This allows competent traders to take advantage of crypto markets while they sleep or manage daily obligations.

Disadvantages of using automated trading

Learning Curves

Depending on which cryptocurrency trade automation product you’ve chosen, you will need to learn the intricacies of that platform as well as have a basic grasp on trading fundamentals.

Some of the beginner focused trading bots offer great preset trading configurations, but don’t allow you to reconfigure with more advanced techniques as your experience increases. If you chose an advanced trading platform as a beginner then you will quickly realise you’re out of your comfort zone and may feel overwhelmed.

If you’re not capable of reading and understanding trading strategies such as crypto arbitraging or crypto scalping then you should reconsider leveraging trade automation until you understand the basics.

Maintenance Required

You often see trade automation being a maintenance free way to generate passive income and that’s just not true. Traders need to maintain active strategies by optimizing for current market conditions and overall market sentiment. There’s also other factors to consider like hardware or server maintenance, broadband connectivity issues, and other technical gremlins.

Security & Privacy

There’s been a recent increase in providers being hacked, which have resulted in compromised API keys, funds lost, and in some cases leading to massive exchange manipulation.

While using web-based cloud products like one of the ones mentioned above, there’s a much greater risk of compromising security threats due to the central hosting of thousands of trader’s account and API information being stored in a single location.

Using an on-premise self managed solution you run a smaller risk of being caught up in a large scale coordinated attack than with a cloud-based automated trading platform. This is partly due to installations being configured separately across different hosting platforms and networks.

Security tips:

- Never use platforms that require full account access

- Don’t allow withdrawal permission on your API keys

- Keep API keys confidential

- Use built-in security features like 2FA, IP whitelisting, and strong passwords

A trader’s privacy is also equally as important, some of the centralized trading platforms monitor users trade activity and strategies. This data is shared with third-parties and is often used to build marketing strategies or promotions to encourage desired behaviors.

Wrapping up our review of our top 5 best Bitcoin trading bots

Should I use free bitcoin trading bots?

One should be extremely skeptical of free Bitcoin trading bots that market high returns with very little risk. There’s several notable instances of companies ripping off consumers looking for cheap or free alternatives to the trade bots listed above. However, open source crypto trading bots are free and can be a great choice for technically capable traders looking for a base to start from.

Are crypto bots legal?

Yes, crypto trading bots are legal! The majority of exchanges offer a public trading API for third-party developers to create tools that help traders maximize time and profit margins. If an exchange does not allow automated trading access to their infrastructure will be terminated.

Do crypto bots really work?

Crypto trading bots have a proven track record with traditional trading markets like Forex and it is no different with cryptocurrency. There are profitable trading strategies that are often converted into automated trading strategies. However, using crypto trading bots is not a hands off experience, one should understand basic trading principles and strive to continually improve trading performance.