Over 295 million people across the world use cryptocurrency, and 33 new types of cryptocurrency are created weekly. Because of the massive impact that digital assets have on society, investors can and should use them as an opportunity to diversify their portfolios.

If you’re one of these investors, analyzing the best crypto trading signals can help you maximize the return on your crypto investments. AI-based technologies are the #1 way to make more money, but it’s important that you understand trading signals and the tools needed to analyze them thoroughly. Read on to learn all you should know when refining your investment strategies.

The Basics of Crypto Trading Signals

Investing in cryptocurrency is beneficial because of its growing value. Bitcoin alone has risen over 140% over the course of the last year, hitting a record high on March 13, 2024.

While it has fallen since then, short-term market volatility is to be expected. Overall, Bitcoin is expected to reach a high of $160,000 by 2030. Many experts anticipate that despite short-term fluctuations, you can make a lot of money on smart investments if you hold them for a few years before trading.

Many other cryptocurrencies like Ethereum, Tether, and Binance are also experiencing profitable long-term growth. You’re not just limited to a single type of crypto, and diversifying your portfolio can lead to better investment strategies.

However, because cryptocurrency is constantly changing, it’s challenging to keep up with current market trends and what constitutes a smart investment.

That’s where crypto trading signals come into play.

These trading signals use automated algorithms to assess the crypto market. You can look into a specific type of cryptocurrency or get more general market insight depending on your needs.

Trading signals come from looking at multiple platforms with several different types of interlinked technology. Following these signals means moving into the crypto market the right way because they offer assistance and direction. They take most of the guesswork out of investing.

Though crypto trading signals have been created manually in the past, AI is revolutionizing the industry. Software is now analyzing indicators on its own with advanced algorithms and finding data analytics and market trends. It can look into historical data accurately, compare it with current trends, and offer market predictions so you can make smarter investments.

Why Is This Important?

As we brushed upon, crypto markets are highly volatile. They’re difficult to predict on your own. Signals offer valuable insight to traders so that they can find buying, selling, and trading opportunities.

These data-backed insights create confidence in the investment strategies used to purchase and sell multiple types of cryptocurrency.

Crypto signals can benefit beginning traders and seasoned crypto enthusiasts alike.

Beginners will enjoy the demystification of market patterns, which is important because these patterns can be complex and difficult to understand. If you’re just starting out, signals can help you understand entry points to the market.

You’ll learn where you should invest in crypto, what currencies you can invest in, and how much makes a good investment for your specific needs. You’ll also get insight into exit points and gain a thorough understanding of how long you should hold onto your investment to maximize your return.

If you’re an advanced trader, crypto signals can benefit you by offering up cryptocurrency tips and data-backed information into the market. This additional data can help you hone your decision-making processes for better short and long-term investments. You’ll be able to make better decisions, refine strategies, and make more money while diversifying your portfolio.

Structured Approaches

Crypto trading signals also add structure to your investment strategy whether you’re a beginner or a seasoned investor.

One way that they do this is by helping you add better-considered stop-loss orders. Stop-loss means that you specify that your crypto will be automatically sold when its value reaches a pre-set price. You decide on this price based on your specific goals and the return you’re looking to get.

When you have the data necessary to create well-thought-out stop-loss orders, you can maximize your ROI without the stress of constantly checking your market investments. You also can manage risks while getting the best possible returns.

It has the potential to greatly decrease your risk/reward ratio!

This is effortless because you won’t even need to change your strategy after creating a stop-loss order. Your automated technology will do all the heavy lifting for you, so all you’ll need to do is profit.

The Best Crypto Trading Signals to Consider

There is a wide range of crypto trading signals to think about when creating a crypto investment strategy. The first are webhooks.

Webhooks are a way that apps can communicate with each other and send automated messages between two applications. You can connect them to AI platforms that assess different signals and get automated alerts when the system identifies an investment opportunity. This centralizes your research so you can get more accurate alerts sent to your inbox.

Technical indicators are another trading signal to consider. These are mathematical indicators including MA, RSI, ADX, MACD, and Bollinger bands. The tools analyze historical data to forecast how a specific cryptocurrency will move through the market and be valued in the future.

Lagging indicators look into the past while leading ones look into the future, and they can combine to give you a holistic outlook.

You also may want to consider getting indicators sent to your email inbox or Telegram app. SMS alerts are also available. This means that you can learn about crypto trends in real-time and make the most informed decisions possible.

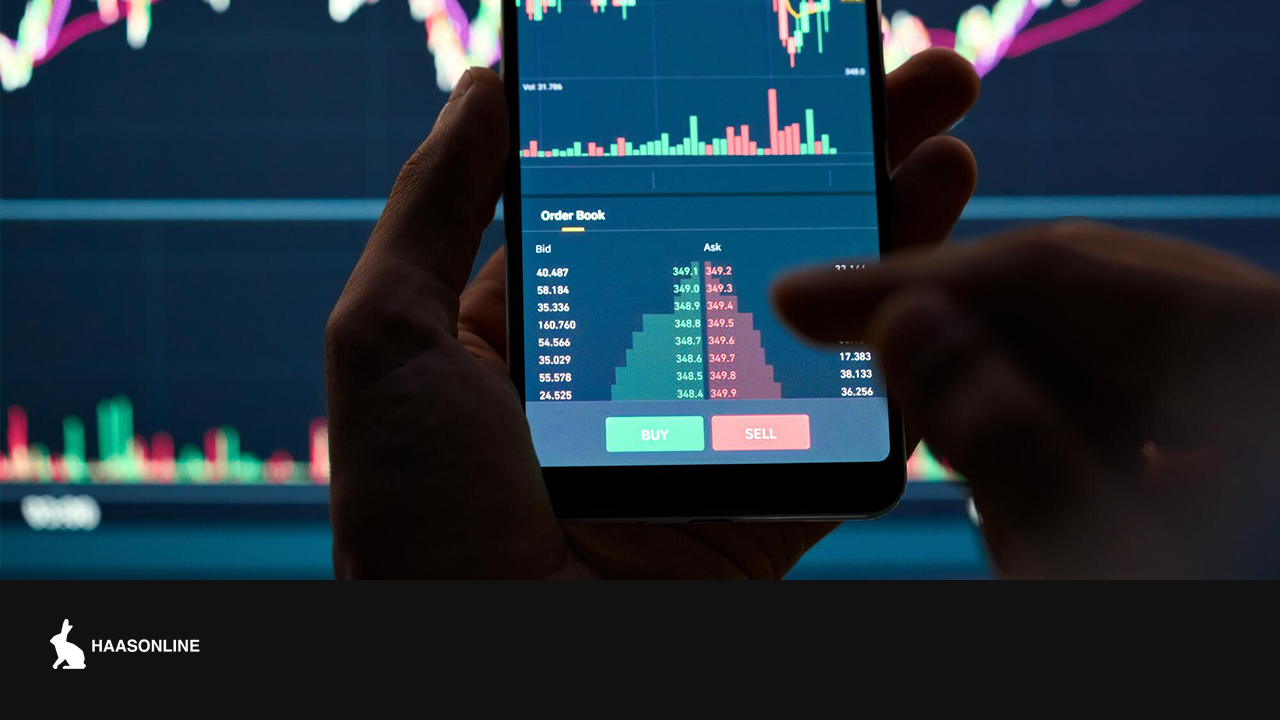

It’s also critical to look into data from major trading platforms like TradingView. These sites provide visual data including charts about crypto trade markets.

You can look at the most up-to-date information and make decisions based on the market assessments that the system tracks. This allows you to make smart decisions from a knowledgeable and reputable platform.

These may sound like a lot of signals to analyze. Luckily, top HaasOnline AI tools can help you hook them all together and assess them within one convenient dashboard.

Using AI Bots for Crypto Trading Signals

As you might imagine, manually assessing data signals from all these sources is time-consuming and challenging.

If you choose to do so yourself, you’ll need to contend with the stress of data analysis that has a real-world impact. Whether you assess information on your own or with expert help, you may also need to deal with issues stemming from human error.

That’s where AI trading bots come into play.

These AI bots use pre-programmed algorithms to predict how the crypto market will move in the future. They take several things into account including mast trends, current trends, volatility, indicators, and even news stories. This information comes from multiple sources to ensure accuracy.

In addition to assessing data automatically, you can also set up bots to automatically execute trades. If you want a little more control, you can just ask them to send you alert notifications about recommendations. This lets you decide whether or not to follow suggested trade signals.

There are many benefits to using quality AI to generate cryptocurrency tips. In addition to saving time and nipping human error in the bud, it can also cut out biases and emotions that you or hired experts have. Since the bots operate 24/7, you also don’t need to worry about missing vital information that could maximize your ROI.

HaasOnline: The Best AI Tool Available

If you’re looking for the best AI tool available, look no further than HaasOnline. Our tool assesses information from tons of sources like TradingView and other major trading platforms. It also looks into data from webhooks, email, telegrams, and other online technical indicators.

While other bot companies close for a wide range of reasons, HaasOnline takes measures to ensure that we don’t succumb to the same mistakes!

Our crypto trading bots replicate manual trading strategies with HaasScript. This is our own scripting language designed to emulate the best research strategies and tried-and-true investment analyses. You can leverage the high speed, precise strategies, and backtesting engine’s historical data to increase your ROI and profit margins.

Additionally, we offer features like:

- HaasScript editors for rapid trade bot and indicator development

- Backtesting and paper trading

- Portfolio management so you can monitor assets

- Crypto bot report generation

- Up-to-date market data

- A customizable dashboard that lets you watch the markets in real-time

Combine this with exchange integrations that accommodate multiple trading styles, and you’ll be ready to create and launch a top-notch investment portfolio ASAP.

Dig Deeper Into Cryptocurrency Tips for Investors

Now that you know the best crypto trading signals for investors from all walks of life, it’s time to begin getting the signals you need to make data-backed, high-return investments.

Our platform is arguably the most advanced available because of our own HaasScript scripting language as well as cloud and server options. We’re excited to assist you with portfolio management, market insights, and more.

Start a free three-day trial of HaasOnline to learn more about investment strategies and beyond.