Table of contents

Introduction

In the world of cryptocurrency trading, understanding the bid/ask spread is crucial. This article aims to provide an in-depth understanding of the bid/ask spread in crypto trading, its calculation, the factors influencing it, and its significance.

What is a Bid/Ask spread?

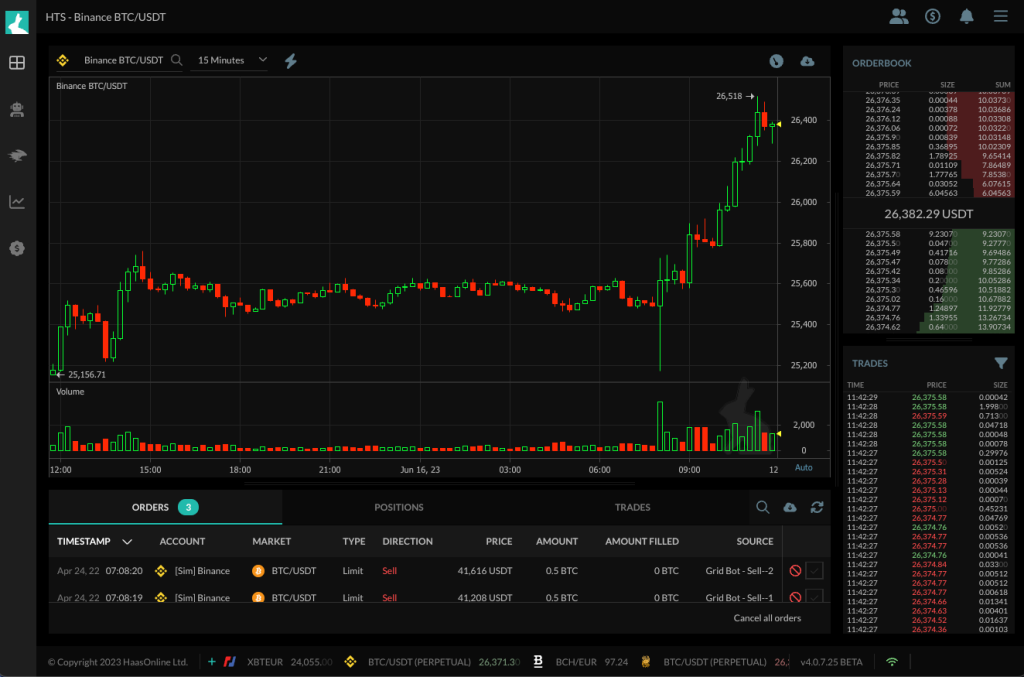

The bid/ask spread, often simply referred to as the ‘spread’, is the difference between the highest price a buyer is willing to pay for an asset (the bid) and the lowest price a seller is willing to accept for that asset (the ask). In other words, it represents the gap between buyers’ and sellers’ price expectations.

For example, if the highest bid for a particular cryptocurrency is $100 and the lowest ask is $102, the bid/ask spread is $2. This spread is a key indicator of the liquidity and volatility of the asset – a smaller spread generally indicates a more liquid market and less price volatility.

What are Bid/Ask prices?

Bid and ask prices are the prices at which buyers and sellers are willing to transact. The bid price represents the maximum price that a buyer is willing to pay for a security. On the other hand, the ask price represents the minimum price that a seller is willing to receive for the security. A trade occurs when the buyer agrees to pay the asking price or the seller agrees to accept the bid price.

Calculating the bid/ask spread

The bid/ask spread is calculated by subtracting the bid price from the ask price. For example, if the bid price is $100 and the ask price is $102, the spread would be $2. This spread is a key indicator of the liquidity and volatility of the asset – a smaller spread generally indicates a more liquid market and less price volatility.

Factors Influencing the Bid/Ask Spread

Several factors can influence the bid/ask spread in crypto trading:

Market Liquidity

Higher liquidity generally results in narrower spreads as there are more buyers and sellers available. This means that trades can be executed quickly and at favorable prices.

Trading Volume

Higher trading volumes often lead to tighter spreads due to increased competition among traders. This competition can drive prices closer together, resulting in a smaller spread.

Market Volatility

Increased trading activity in volatile markets typically results in a wider bid/ask spread. This is because traders demand a larger premium for taking on the increased risk associated with volatile markets.

Exchange Fees

The fees charged by exchanges for facilitating trades can also impact the bid/ask spread. Higher fees can lead to wider spreads as traders incorporate these costs into their pricing strategies.

Significance of the Bid/Ask Spread

The bid/ask spread is significant for several reasons:

Assessing Market Conditions

The spread can provide insights into the market conditions. A narrow spread often indicates a highly liquid market, while a wide spread may suggest lower liquidity.

Evaluating Transaction Costs

The spread represents a cost of trading. A wider spread means that a buyer will pay more for a security than a seller will receive, with the difference going to the market maker or broker.

Market Efficiency

The spread can also be an indicator of market efficiency. In an efficient market, the spread should be minimal, allowing for quick and fair trades.

Conclusion

Understanding the bid/ask spread is crucial for successful crypto trading. It provides insights into market conditions, helps evaluate transaction costs, and indicates market efficiency. By keeping an eye on the spread and understanding what influences it, traders can make more informed decisions and potentially improve their trading outcomes.

References

- “Understanding Bid-Ask Spread in Cryptocurrency Trading.” Coin360. Link

- “What Is a Bid-Ask Spread, and How Does It Work in Trading?” Investopedia. Link

- “What is Bid-Ask Spread: How it Keeps Crypto Markets Efficient.” Phemex. Link

- “Spread Trading: What does a spread mean in crypto trading?” Phemex. Link

Frequently Asked Questions

The bid/ask spread is the difference between the highest price a buyer is willing to pay for an asset (the bid) and the lowest price a seller is willing to accept for that asset (the ask).

The bid/ask spread is calculated by subtracting the bid price from the ask price.

Several factors can influence the bid/ask spread, including market liquidity, trading volume, market volatility, and exchange fees.

The bid/ask spread is significant because it provides insights into market conditions, helps evaluate transaction costs, and indicates market efficiency.