Using Bollinger Band with Trade Strategies

For newer cryptocurrency traders, learning how to successfully time market entries and exits is a fundamental challenge. It’s also often a difficult one, given the considerable volatility of the market.

Technical trading tools help level the playing field, giving traders access to indicators that can help identify developing market trends and opportunities. One of the most popular and useful of these indicators are “Bollinger Bands.”

To help you learn more about technical trading strategy, let’s take a closer look at the ideas behind Bollinger Bands, and how the bands are used in cryptocurrency trading. This article is merely meant to serve as a helpful resource, not advice.

What is a Bollinger Band?

Bollinger Bands are a technical analysis tool that traders use to identify developing market opportunities. The moving average of an asset’s price is plotted on a chart, and this line is then bracketed by an upper and a lower line. These lines are set two standard deviations apart.

These middle, upper and lower lines are called bands, and they represent price channels. Bands are typically charted over the course of 20 periods — these periods may be days or even hours, depending on whether the trader is taking a short or long-term approach. Many traders will increase or decrease the deviations if the number of periods being charted is longer or shorter.

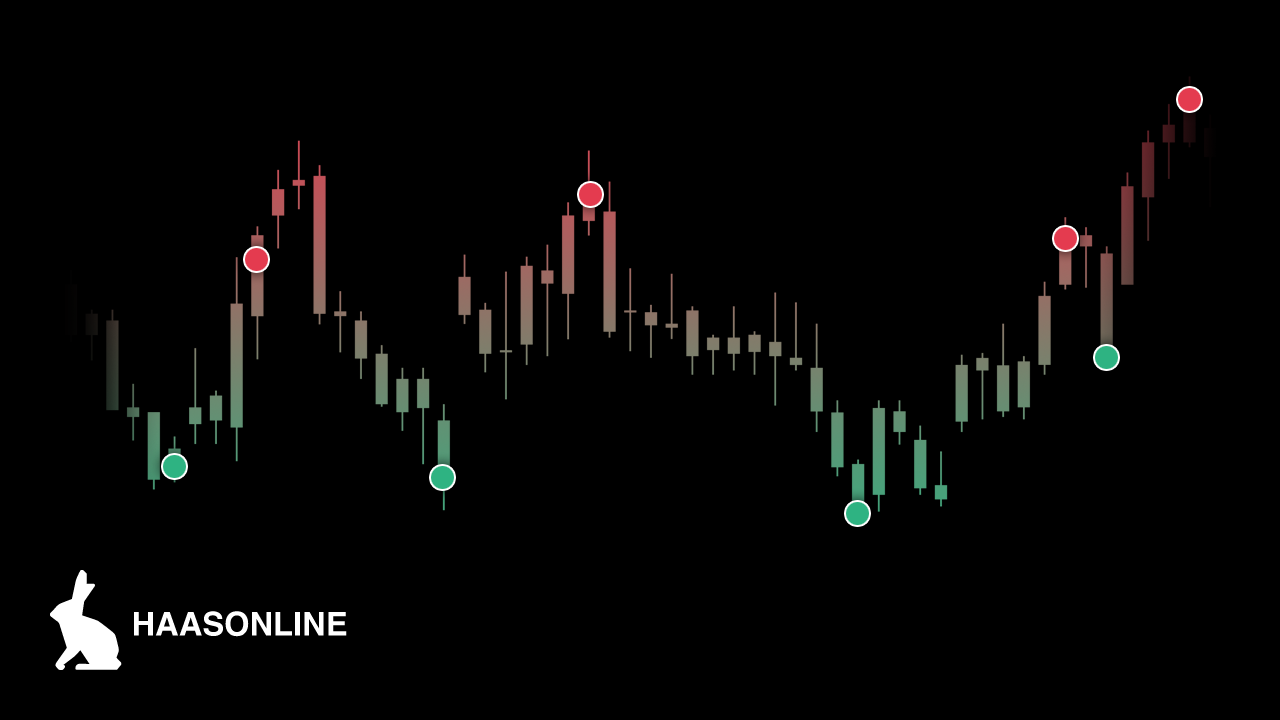

At their core, Bollinger Bands are a tool to help traders visualize overbought or oversold assets. According to trading theory, the closer the price moves to the upper band, the more overbought the market. This is generally considered to be a sell signal. Conversely, if the price moves toward the lower band, the market may be oversold, which may signal that it’s time to buy.

The concept of Bollinger Bands was pioneered in the 1980s by John Bollinger, a well-respected trader and market technician. Since then, it has become a cornerstone technical trading strategy in both the equities and cryptocurrency markets. Unlike a simple moving average that tracks the price of an asset over time, Bollinger Bands also help traders track volatility, giving them a clearer picture of market trends and opportunities.

How to Use Bollinger Bands in Cryptocurrency Trading

Bollinger Bands are used by cryptocurrency traders much in the same way that they are used by stock market traders — essentially as a tool to identify overbought and oversold assets. A crypto trader may use Bollinger Bands to track the performance of an asset like Bitcoin over 20 periods, then make buy or sell decisions based on the formations that develop.

Bollinger Bands can be especially helpful when trading cryptocurrency, as the market is notoriously volatile. Bollinger Bands can be used to identify possible breakouts and the optimal times to enter or exit a position.

One of the core ideas of the Bollinger Band is the “squeeze,” which occurs when the bands move closer to each other. This movement is generally considered to be a sign of increased volatility, and, subsequently, new trading opportunities. When Bollinger Bands move further apart, this often means lower volatility — a sign that it may possibly be time to exit a trade.

If price action exceeds the bands in either direction, this is considered a “breakout.” Because roughly 95-percent of price action rests between the bands, a breakout is considered a significant price movement. It is not necessarily, however, a trading signal, though it is often mistakenly believed to be one.

Bollinger Bands are frequently deployed to analyze the strength of a trading trend. If a trend is strong, the price generally sticks closer to the upper band. When price begins to pull away from the upper band, it’s often an indication that a trading trend is losing steam. So, for example, if an asset’s price is in a downtrend and remains very close to the upper band for an extended period, a trader will usually interpret this as a bearish sign, and act accordingly.

Bollinger Bands play a crucial role in automated cryptocurrency trading. In such cases, traders can deploy advanced trading bots that are programmed to recognize and act on technical indicators, including Bollinger Bands and key variants.

Bollinger Band Variations: %B and %W

Traders should also be cognizant of two other indicators based on Bollinger Bands: Bollinger Bands %B (or percent bandwidth) and Bollinger Bands %W (or W Bottom). The Bollinger Band %B indicator quantifies where price is relative to the bands. So, for example:

- A %B Above 1 would mean that the price is above the upper band

- A %B Equal to 1 means that price is at the upper band

- A %B Above .50 means that price is above the middle band

- A %B Below .50 means that price is below the middle band

- A %B Equal to Zero means that price is at the lower band

- A %B Below Zero means that price is below the lower band

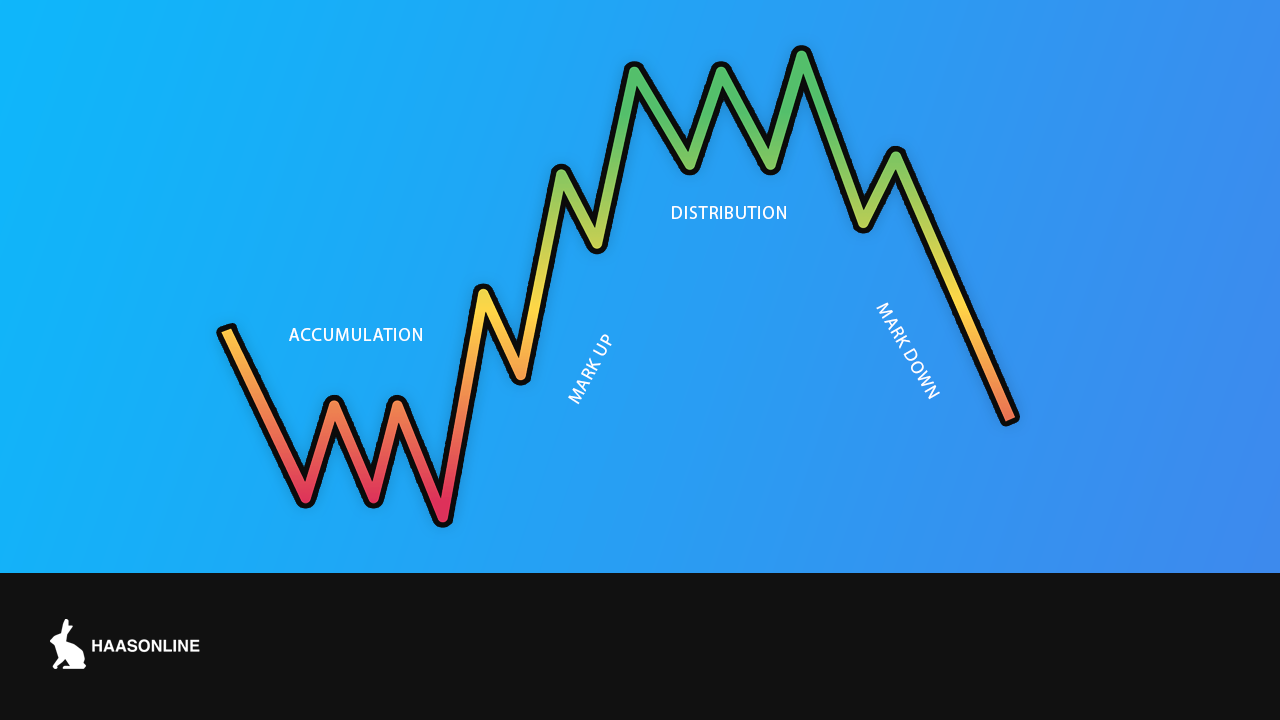

By using %B as a simple indicator, traders can often identify trends and signals. Bollinger Bands can also be used to confirm so-called “W-Bottoms” or double bottoms. These W shaped formations occur in a downtrend and are identified by Bollinger Bands when a second low is lower than the first, but stays above the lower band. By making this identification, traders can exploit opportunities presented by the possibility of imminent trend reversals. For example, the appearance of a W bottom may give traders more confidence buying after the second low, as an uptrend may be at hand.

The M Top Formation

Another Bollinger Band formation that traders look for is the “M Top.” This is formed when a high is followed by a sell-off that’s subsequently followed by a retest of the first high. The second high may be lower or higher than the first. When this formation occurs, Bollinger Band analysis can help traders determine whether an asset is in a new uptrend or if it is facing resistance.

Let’s look at one example: If the first high is equal to or outside the upper band, and the sell-off reaches the middle band, traders will often consider selling if the second high fails to reach the upper band, as this indicates an uptrend may not be present. Should that second high break through the upper band, however, that could indicate resistance is broken, signaling that a buy is in order.

By studying basic formations such as Double Bottoms and classic M Tops, traders can help time their entries and exits with greater precision.

The Takeaway

Bollinger Bands are a cornerstone technical trading tool used by vast numbers of traders every day to identify developing trends and opportunities in the cryptocurrency market. By studying Bollinger Bands cryptocurrency trading formations, you can help determine whether a digital asset is overbought or oversold, and make your trading decisions accordingly.

For more information about how Bollinger Bands can be deployed in advanced automated crypto trading, please visit this resource.