In the dynamic world of cryptocurrency trading, where volatility is the norm, understanding and leveraging various trading strategies is crucial for both novice and experienced traders. One such strategy is gap trading, a technique that can be highly profitable when executed with precision and due diligence. This article delves deep into the concept of gap trading, exploring its types, reasons for appearance, and the subsequent actions that follow when a gap is filled. By the end of this guide, readers will gain an in-depth understanding of how to master gap trading in the cryptocurrency market.

Table of contents

What Is a Gap?

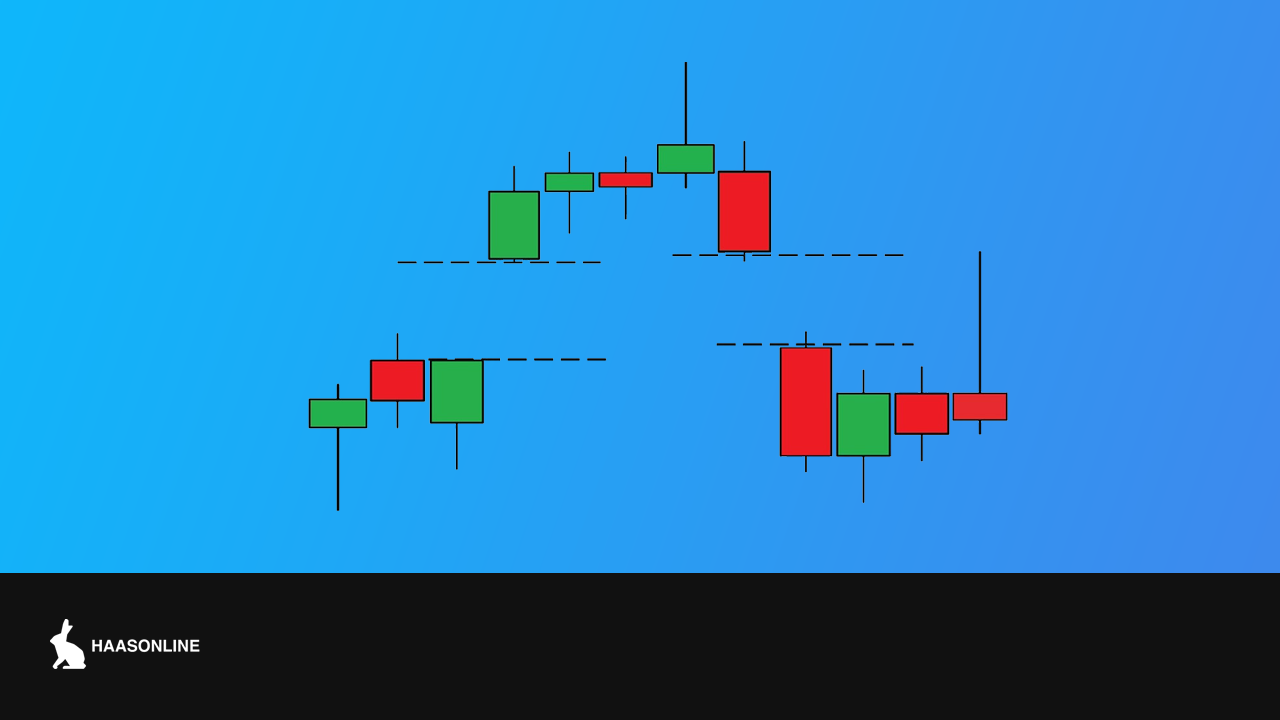

A gap represents a discontinuity in the price chart of a cryptocurrency, where no trading activity has occurred. It is essentially a sharp break between the high price of one period and the low price of the following period. Gaps are categorized into four main types:

Common Gap

This type of gap is the most prevalent and usually manifests within standard price configurations. It often emerges due to various news disclosures or specific occurrences. Common gaps generally get filled promptly as market actors respond to the unfolding news or events.

Breakaway Gap

Breakaway gaps typically materialize at the commencement of a new trend or when there is a substantial shift in technical or fundamental dynamics. These gaps illustrate a potent shift in market sentiment and are often a precursor to a breakout from a consolidation period. The likelihood of breakaway gaps not being filled shortly is relatively high, reflecting the significant market realignment they represent.

Runaway Gap

Runaway gaps are characteristic of an ongoing trend and denote a robust and enduring movement in the trend’s direction. Contrary to common gaps, which are usually filled swiftly, runaway gaps tend to remain unfilled for a considerable duration. They are indicative of substantial market momentum and often signal the perpetuation of the existing trend. For traders, a runaway gap may serve as a directive to maintain alignment with the trend and possibly augment existing positions.

Exhaustion Gap

Exhaustion gaps are typically observed towards the culmination of a trend or an extended price movement. They represent the last burst of buying or selling activity, hinting at a potential trend reversal or a temporary halt in the ongoing trend. The appearance of an exhaustion gap can act as a cautionary indicator, suggesting that the market might be approaching a saturation point.

Why Do Gaps Appear?

Gaps appear on the price chart due to various reasons, ranging from impactful news to technical factors. Understanding why a gap has appeared is crucial for determining its significance and potential impact.

Important News

Gaps often manifest due to the unveiling of pivotal news or events that have a substantial impact on the market. Such events encompass earnings disclosures, the release of economic data, geopolitical shifts, or any other announcements with the potential to alter market conditions. The introduction of new, significant information can lead to a disparity between the closing prices before the market closes and the opening prices when it reopens, creating a gap.

Market Sentiment Shifts

A sudden alteration in market sentiment is another catalyst for the occurrence of gaps. Such shifts can be attributed to variations in investor confidence, alterations in market anticipations, or modifications in overarching economic elements. For instance, uplifting news or a sudden influx of buying interest can result in a gap-up, while adverse news or intensified selling pressure can precipitate a gap-down in prices.

Trading Halts or Suspensions

Occasionally, gaps are a consequence of a temporary halt or suspension in the trading of a specific asset. Such interruptions can be due to regulatory interventions, corporate occurrences like mergers or acquisitions, or other logistical reasons. Upon the resumption of trading, the initial opening price may diverge significantly from the closing price prior to the halt, leading to the formation of a gap.

Technical Factors

Technical elements and patterns within price charts also have the propensity to induce gaps. A gap may emerge due to a breakout from a period of consolidation or a surpassing of crucial support or resistance thresholds. Gaps originating from such technical factors are often interpreted as manifestations of intense buying or selling momentum and can signal impending alterations in market behavior.

What Happens When a Gap Is Filled?

Filling a gap refers to the price action moving back to the level where the gap started. When a gap is filled, it can lead to different market scenarios:

Normal Price Action

When dealing with a common gap, a phenomenon that occurs relatively frequently, the act of filling the gap is perceived as a standard component of price action. The market’s response to the news or events that instigated the gap, through buying or selling momentum, may drive the price to revert to the closing level of the previous day. This reversion is interpreted as a routine correction subsequent to the initial gap.

Support or Resistance Confirmation

At times, a filled gap can serve to validate levels of support or resistance. Should the price fill a gap and subsequently rebound from that point, it could signify that the level at which the gap occurred has evolved into a crucial area of support or resistance. Such price points are often scrutinized by traders to evaluate prospective price trajectories and to identify potential trading prospects.

Trend Continuation or Reversal

Under certain circumstances, the process of a gap being filled can be indicative of either the perpetuation or the reversal of the existing trend. For instance, if a gap formed due to a breakout is promptly filled and the price persists in its original direction, it implies the continuation of the trend. Conversely, if a gap is filled and the price is unable to maintain its position above or below the gap level, it could denote a potential reversal of the trend or a phase of consolidation.

Market Sentiment Assessment

Analyzing the filling of a gap can also yield insights into the prevailing market sentiment and the behaviors of investors. A gap that is filled swiftly may reflect that the market participants have assimilated the initial news or events that led to the gap and have adopted a relatively balanced stance. On the other hand, a gap that remains unfilled or is slow to fill may imply a more entrenched and enduring sentiment within the market.

How to Trade the Gap in Crypto

Mastering gap trading involves a series of well-calibrated steps, each crucial in ensuring the success of the trade.

Identify the Gap

Begin by pinpointing the existence of a gap in the price chart. Search for a notable disparity between the closing and the subsequent opening prices. Different kinds of gaps, like breakaway or exhaustion gaps, necessitate varied trading strategies. HaasOnline’s trading bots can be programmed to automatically detect such gaps, allowing traders to respond promptly to emerging opportunities.

Assess the Gap Type and Context

Delve into the characteristics of the gap and its possible ramifications. Evaluate the driving forces behind the gap, the prevailing market sentiment, and the ongoing trend. This evaluation aids in selecting the suitable trading approach. HaasOnline’s bots can assist in this assessment by analyzing market conditions and applying predefined criteria to determine the nature of the gap.

Confirm the Direction

Determine the expected direction of price movement to fill the gap by leveraging technical indicators, chart patterns, or fundamental factors impacting the cryptocurrency. Utilize technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, which can be integrated into HaasOnline’s trading bots. These bots, employing sophisticated algorithms, can assist in substantiating the direction by meticulously analyzing diverse indicators and patterns, thereby facilitating more precise forecasts.

Entry and Exit Points

Demarcate distinct entry and exit points for the trade. Some traders opt to enter at the market’s inception post the gap, while others may await a retracement or a confirmation of a breakout. Establish your risk threshold and implement stop-loss orders to safeguard against unfavorable price shifts. HaasOnline’s bots can automate this process, executing trades at predefined levels and managing risk according to set parameters.

Monitoring and Adjustment

Persistently oversee the price movements and the prevailing market conditions as the trade unfolds. Be ready to modify your strategy if the situation demands. If the price trajectory aligns with your expectations and the gap starts to diminish, contemplate securing partial profits or adjusting your stop-loss to preserve gains.

Stay Informed

Maintain awareness of the most recent news and developments that could influence the cryptocurrency market. News with the potential to move the market can engender gaps, and staying abreast of such information can enable the anticipation of prospective trading opportunities. HaasOnline’s bots can be integrated with news feeds and alerts, ensuring that traders are well-informed and able to react swiftly to market developments.

Gap Trading Strategies and Tips

Several strategies and tips can be employed to maximize the profitability of gap trading:

Gap Fading Strategy

This strategy involves trading against the direction of the gap, anticipating that the gap will fill and the price will revert to its previous level.

Gap Continuation Strategy

Traders using this strategy expect the price to continue moving in the direction of the gap, capitalizing on the momentum.

Gap Reversal Strategy

This strategy is premised on the assumption that the gap is signaling a culmination of the prevailing trend and a potential inversion is imminent. Traders adopting this strategy would align their positions against the gap’s direction, intending to profit from the anticipated price reversal. Leveraging HaasOnline’s platform can aid in confirming potential reversal points through its array of technical indicators and chart pattern recognition.

Volume Analysis

Examining the trading volume concomitant with the gap can yield invaluable insights. A surge in volume often denotes intensified market engagement and augments the probability of the gap being persistent or extended. Conversely, diminished volume might signify frail market conviction, enhancing the likelihood of a gap reversal or fill.

Support and Resistance Levels

Identifying key support and resistance levels can provide insights into potential reversal points and breakout levels.

Timeframe Considerations

The efficacy of gap trading strategies is contingent on the trading timeframe. Shorter timeframes are apt for swift gap fills or intraday trades, while extended timeframes are suitable for gaps requiring a longer duration to close or for swing trading approaches.

Pre- and Post-Gap Analysis

Analyzing the price action before and after the gap can offer valuable insights into market sentiment and potential future movements.

Practice Risk Management

Risk management is paramount in gap trading, akin to any trading strategy. Ascertain your risk appetite, implement stop-loss orders, and calibrate position sizing judiciously. Being cognizant of “runaway gaps,” where prices intensify in the gap’s direction, is crucial as it can culminate in losses surpassing expectations if not mitigated appropriately.

Conclusion

Gap trading in the cryptocurrency market is a nuanced strategy that, when executed with knowledge and precision, can offer substantial rewards. By understanding the different types of gaps, the reasons behind their formation, and the implications of a gap being filled, traders can make informed decisions to navigate the volatile crypto market successfully. Employing various gap trading strategies, staying informed about market developments, and practicing robust risk management are pivotal in mastering gap trading in cryptocurrency.

Frequently Asked Questions about Gap Trading

A gap is a discontinuity in the price chart of a cryptocurrency, indicating a range where no trading activity has occurred.

Gaps appear due to various reasons such as important news, market sentiment shifts, trading halts or suspensions, and technical factors.

Traders can benefit from gap trading by accurately identifying gaps, assessing their types and context, confirming the direction, and employing suitable automated trading strategies to capitalize on the price movements.

While gap trading can be profitable, it also involves risks, and like most strategies has risk.