Can you outperform established crypto fund managers?

It’s been over ten years now since the emergence of the Bitcoin blockchain and the publication of Satoshi Nakamoto’s famous Bitcoin whitepaper. In that time, cryptocurrencies have matured rapidly as an asset class and have even started to gain a foothold in the traditional finance industry.

As a result of its ongoing maturation, the investment market for cryptocurrencies has naturally began to resemble that of more traditional investment vehicles. This includes the rollout of cryptocurrency index funds over the past few years. Now you can manage your crypto index strategy and compete with funds like Coinbase Index Fund (RIP), Bitwise10, or Bloomberg Galaxy Crypto Index.

While there can sometimes be substantial monetary barriers to entry to the tune of tens of thousand of dollars when it comes to investing in a professionally-managed cryptocurrency index fund, it is easier than ever to enjoy the benefits of crypto index funds without having to overcome such hurdles.

What are Cryptocurrency Index Funds?

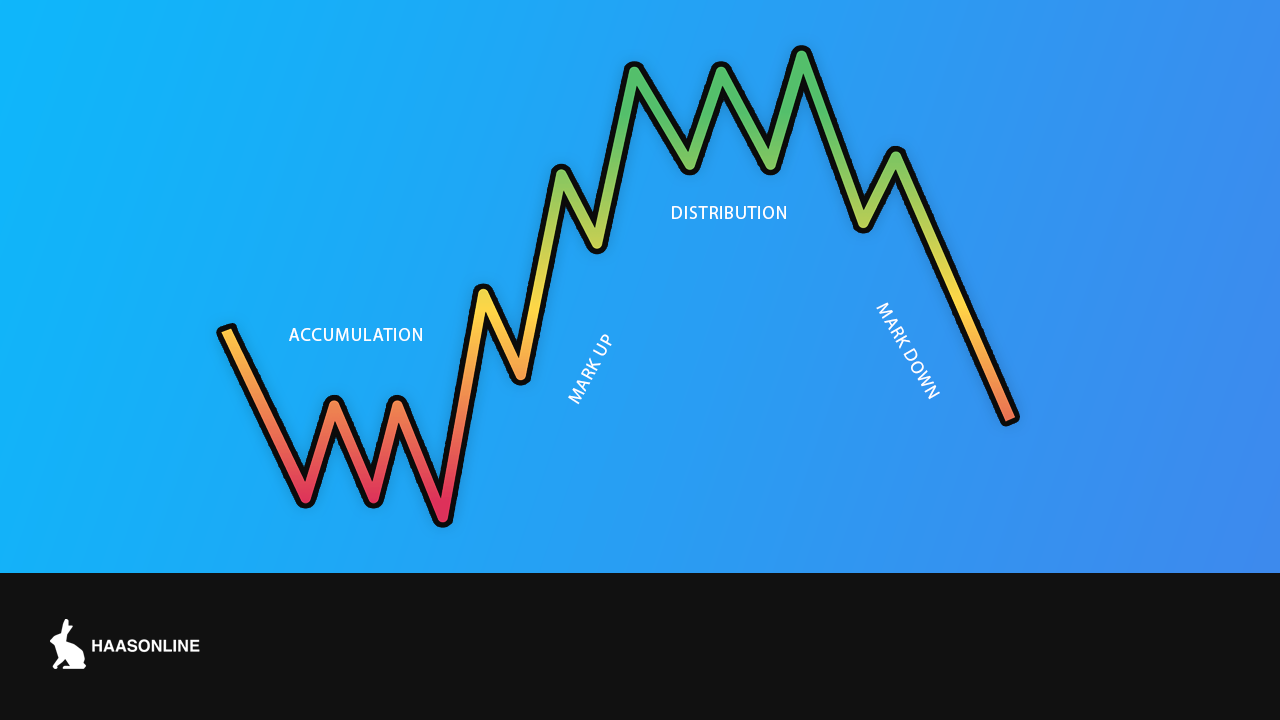

In general, index funds are portfolios of securities that seek to track market indexes in terms of both composition and financial performance. Major stock indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. Index funds are regarded as an effective way to minimize trading fees and gain broad exposure to the market, thereby achieving diversification at a low cost.

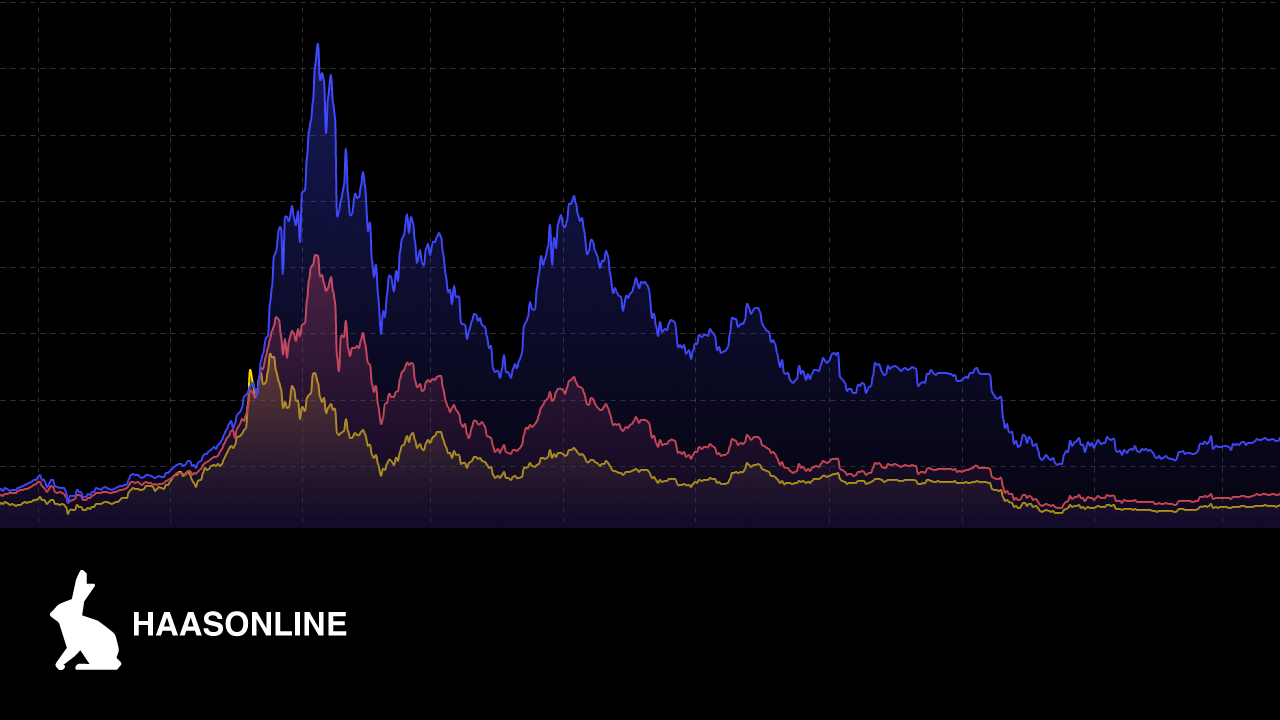

Index funds have been gradually gaining in use and popularity in the past decades, as they have proven to outperform most active managed funds and are very accessible to the average investor. Following the explosion in popularity over the past couple of years, it was only a matter of time until cryptocurrency index funds emerged as alternatives to traditional index funds.

Investing in cryptocurrency index funds has some notable advantages over picking and choosing specific coins. In particular, cryptocurrency index funds:

- Give broad exposure to the crypto market easily and at low cost

- Allow focus on particular segments of the market (based on size or category)

- Distributes the risk of any particular cryptocurrency failing

- Can be set up and managed yourself

The first three benefits are largely the same as traditional index funds, but the fourth is unique to crypto index funds. This is because traditional index funds must be purchased from a brokerage firm or directly from a mutual fund company. In that way, your investment options are constrained by the index funds available at a given time. With crypto index funds, it is quite easy to replicate the portfolio holdings of a professional crypto index fund like the Bloomberg Galaxy Crypto Index from the comforts of your own computer, without needing to purchase the index directly from a broker or open any special accounts.

HaasOnline, The HaasBot, and Crypto Index Construction

With HaasOnline Trade Server, it is easy to replicate the crypto index fund of your choice. You only need to identify your desired portfolio mix of cryptocurrencies and set up an automated trading bot according to those parameters. The HaasBot will do the rest.

If you don’t particularly like the portfolios that any of the professional crypto index funds offer on the market today, you can also simply create your own. As a result, it is possible to enjoy the benefits from crypto index funds in a way not feasible in the traditional financial sector, with customization options and individual management to boot.

The HaasOnline software is integrated with over twenty of the largest cryptocurrency exchanges on the market today, from BitMEX and Binance to Coinbase Pro. There are no exchange restrictions or trading fees on the HaasOnline platform, as we believe that what you earn is yours to keep.

Use HaasOnline trading bots to automate strategies across dozens of cryptocurrency exchanges in minutes.

Cryptocurrency Portfolio Trading Bots

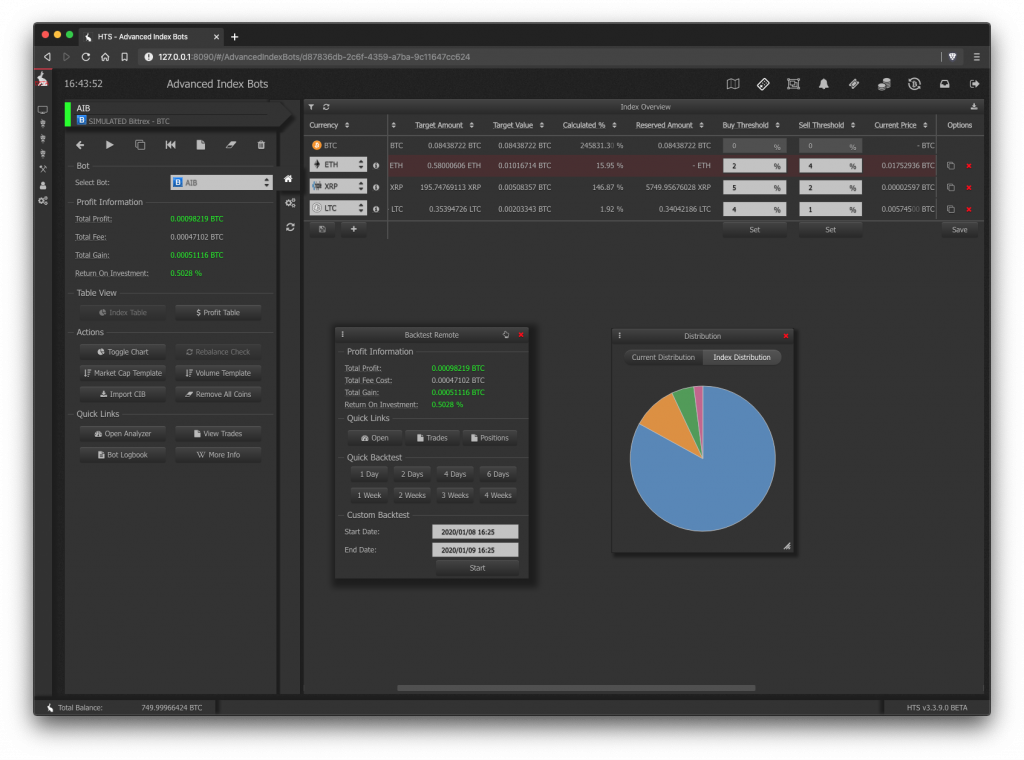

As mentioned earlier, it is simple to set up trading bots that automate the work of maintaining a balanced portfolio. Furthermore, the HaasOnline index bots can be backtested, allowing you to see how your portfolio would have performed historically. For a visual demonstration of how to use the HaasBot to set up and manage your own cryptocurrency index fund, please watch this video.

Here are a few of the different bots one can set up in the HaasOnline Trade Server that are especially helpful in constructing or replicating crypto index funds:

Crypto Index Bot

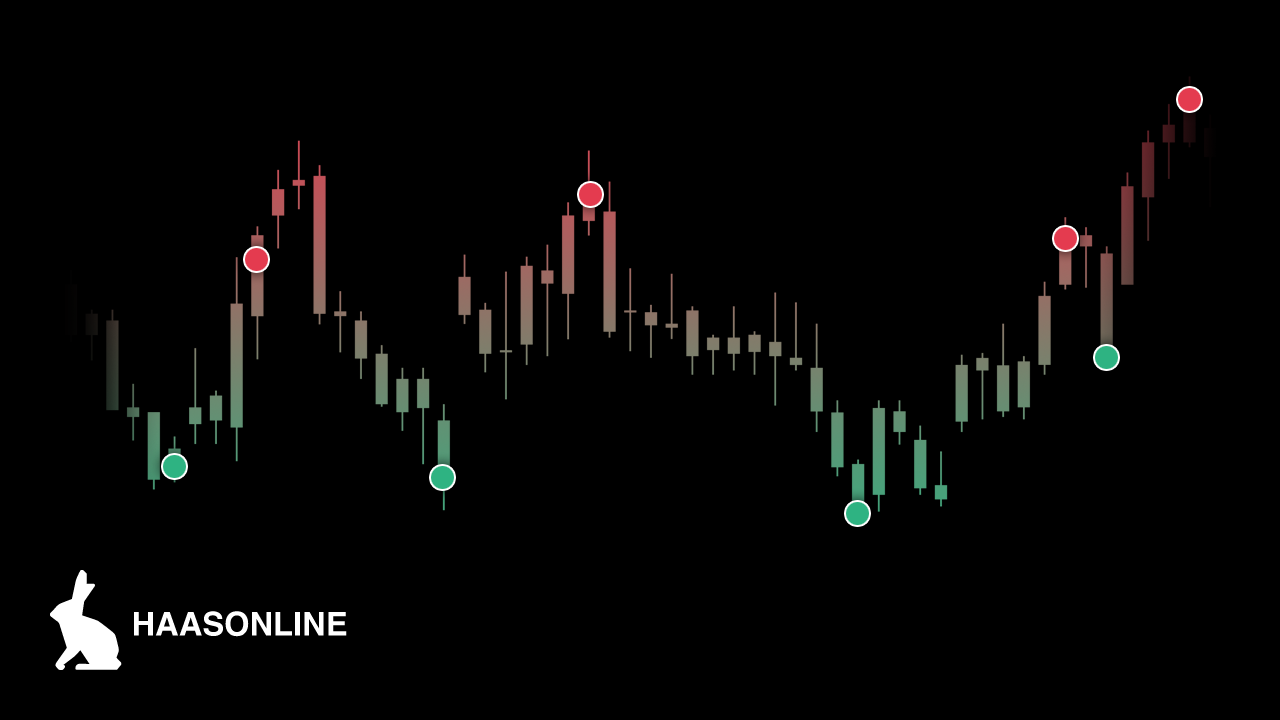

The Crypto Index Bot allows users to design and maintain their own cryptocurrency portfolios within the HaasOnline trading platform. Choose the exchange of your choice, the crypto coins you wish to hold in your portfolio, whatever percentage of each you wish to hold, and buy/sell thresholds in the event of price movements that necessitate portfolio rebalancing. The Crypto Index Bot will automatically rebalance your assets once they have breached the customized value thresholds set for each currency.

Advanced Index Bot

The Advanced Index Bot offers more granular configuration of index settings than the standard Crypto Index Bot. Like the Crypto Index Bot, the Advanced Index bot will automatically re-balance your assets when the value of one of the currencies has changed or breached a pre-set threshold. You can manualy set which digital assets to hold or choose preconfigured templates like market cap and market volume with weighted or equal distribution.

In addition to such automated trading bots, HaasOnline offers a range of insurances, safeties, and technical indicators that can be combined for unique and innovative strategies. These insure that you have the tools at your disposal to set up your automated crypto index fund in the way that best suits your goals.

Use the HaasOnline platform to trade on over twenty of the largest crypto exchanges on the market today.

Find Out More About HaasOnline

HaasOnline offers three different license tiers in the Beginner, Simple, and Advanced plans. The original Crypto Trading Bot, a number of insurances, safeties, and indicators, and all exchanges are available at the Beginner tier, with the more advanced bots like the Advanced Index Bot and the Inter-Exchange Bot available at the Advanced tier. All plans come with unlimited trades, no fees, and friendly chat & ticket support.

Please let us know if you should have any questions about the HaasBot or how to construct your own cryptocurrency index fund. We look forward to helping you take control of your automated crypto trading strategies and construct the right crypto index fund for you.