An Overview of Crypto Taxes

Death and taxes are said to be the only things you cannot escape in life. When the latter is mixed with the world of cryptocurrency trading and investing, things can quickly become confusing and unclear.

In this article, we break down the fundamentals of cryptocurrency taxes for our traders that reside in the U.S. We discuss how the asset class is treated from a tax perspective and also outline the process for properly reporting the gains, losses, and income associated with your crypto trading activity.

Cryptocurrencies are Treated as Property

Contrary to what their name suggests, cryptocurrencies are not currently treated as currency in the eyes of some governments. The IRS (the tax collecting agency of the U.S) makes clear in its official virtual currency tax guidance that cryptocurrencies are to be treated as property for tax purposes.

What does this mean?

This means that all cryptocurrencies such as Bitcoin, Ether, XRP, and other altcoins need to be treated similarly to any other form of property like stocks, real-estate, or bonds from a tax reporting perspective.

In other words, capital gains and losses tax reporting rules apply to cryptocurrencies just like they do for stocks and bonds.

Cryptocurrency Capital Gains

Whenever you dispose of a cryptocurrency (get rid of it), you realize a capital gain or capital loss on the disposal.

The IRS considers all of the following to be disposal events for cryptocurrency (also known as taxable events):

- Selling crypto for fiat

- Trading one crypto for another

- Using crypto to buy goods or services

Let’s take a look at a couple of examples to further illustrate how this works.

Example 1

Craig purchased 1 Bitcoin for $10,000 in April. Five months later, Craig sold that Bitcoin for $12,000.

In this example, Craig realizes a taxable event when he disposes of his Bitcoin by selling it for fiat. He realizes a $2,000 capital gain upon disposal (Sale Price – Purchase Price). Depending on what personal income tax bracket Craig falls under, he will pay a percentage of tax on this capital gain.

Example 2

John also purchased 1 Bitcoin for $10,000. However two months later, John traded 0.5 of that Bitcoin for 30 Ether. At the time, the 30 Ether was valued at $6,000.

In this example, John is disposing of his Bitcoin by trading it for ETH. This incurs a taxable event, and John realizes a capital gain or capital loss.

John’s cost basis for the 0.5 Bitcoin that he traded was $5,000 (0.5*10,000). The 30 ETH John traded for was worth $6,000 at the time of the trade, so John incurs a $1,000 capital gain on the transaction (6,000 – 5,000).

The Difficulty for Traders

As you might have realized from these examples, calculating gains and losses can become quite tedious for high volume cryptocurrency traders—especially when you are actively trading crypto with on our automated trading products. This challenge stems from the fact that your crypto trades are most often quoted in other cryptocurrencies while your capital gains and losses need to be reported in your home fiat currency (US Dollar).

To effectively calculate your gain or loss from each trade, you need to know what the fair market value was in US Dollar for your cryptocurrencies at the time of the trade.

Data aggregators like CoinMarketCap can be used to track down this data by hand. Alternatively, cryptocurrency tax software products like CoinLedger.io can automate the entire crypto tax reporting and calculation process.

Do Capital Losses Reduce Your Tax Liability?

Yes! While capital gains increase your taxable income, capital losses lower it—meaning you’ll pay less to Uncle Sam by filing your losses.

In the U.S., you need to report each taxable event whether it is a capital gain or a capital loss. One common misnomer amongst traders is that if they lost money overall, they do not need to report. This is not true, and they will actually miss out on large tax savings by not reporting losses!

How Do I Report My Gains and Losses?

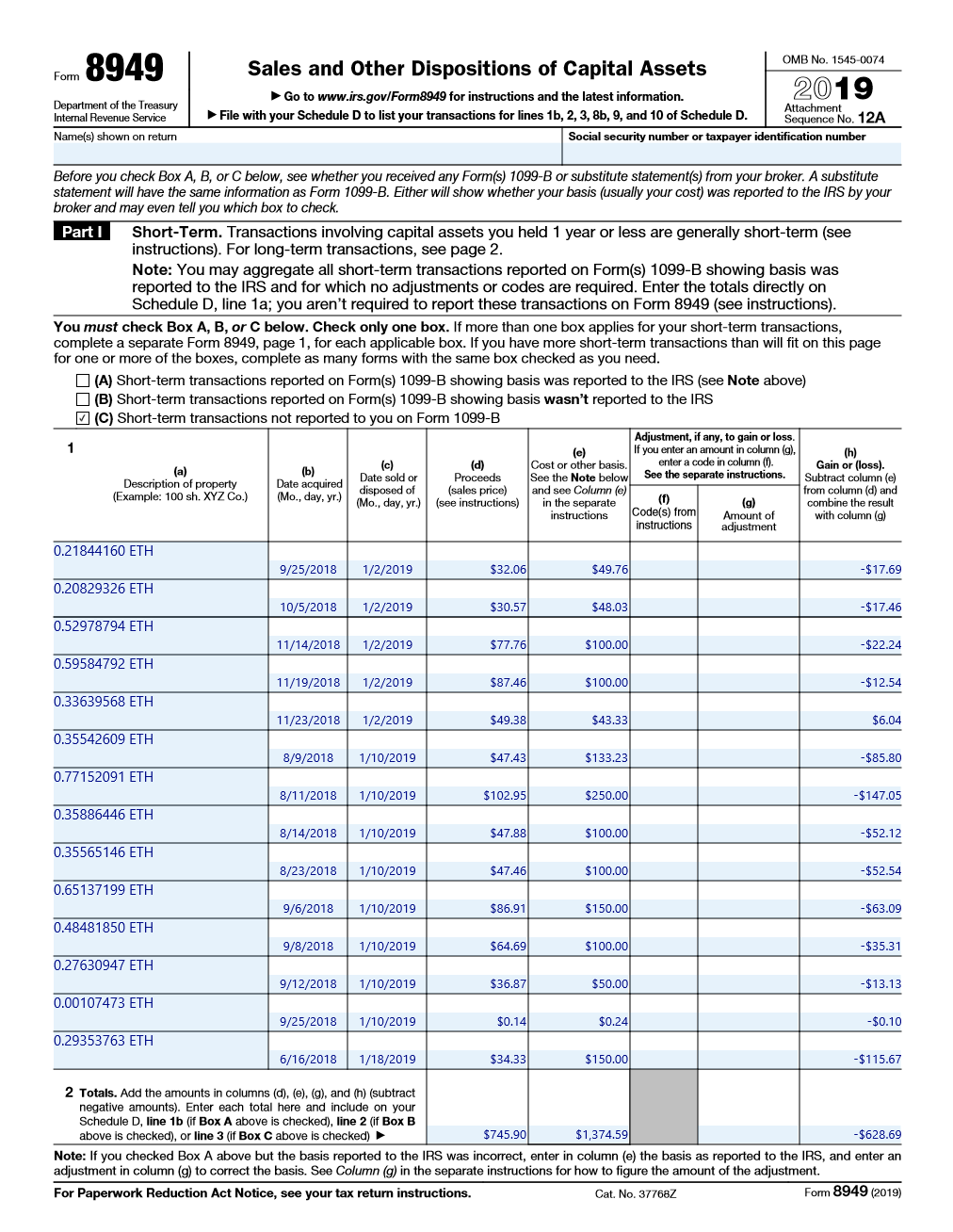

Capital gains and losses get reported on Form 8949. Simply report each taxable event (disposal) that you have within the tax year on a separate line of 8949. Once all disposals are entered, add them up to arrive at your net capital gain or loss.

For each row on 8949 you will need to include:

- A description of the property sold

- Original purchase date

- Date sold

- Proceeds from the sale (in USD)

- Cost basis in the property (in USD)

- Gain / Loss

Below is an example of a filled out 8949 from a trader who was disposing of Ether.

Schedule D

Once you have your net capital gain or loss from all of your cryptocurrency disposals reported on 8949, you simply transfer this number to Schedule D of your tax return. Include both of these documents with your holistic tax return.

Cryptocurrency Tax Software

If you are looking for an easy way to automate your crypto tax reporting, it may be helpful to checkout some of the tools that have been specifically developed to help crypto traders with their tax reporting.

HaasOnline has teamed up with CoinLedger.io to help enable a more streamlined tax reporting for our U.S. traders.

CoinLedger integrates with most of the major exchanges we support to allow you to import your historical crypto transactions directly into their app. You can then generate your capital gains and losses tax forms based on this data with the click of a button.

HaasOnline users can use the discount code CRYPTOTAX10 to receive 10% off any CoinLedger.io report.

Tips & Tricks

To ensure that you will be able to easily report your crypto taxes at year end, make sure you are keeping track of the various exchanges and platforms you are using to trade. If you are a heavy user of multiple exchanges, it can be easy to lose track of everything you did over the course of the year. To avoid this, make sure to keep clean records.

Once year end comes around, you will easily be able to account for all of your trades and transactions with these records and get your tax reporting done in no time.

For more information on the intricacies of cryptocurrency taxes, checkout this guide: The Complete Guide to Cryptocurrency Taxes & Everything You Need to Know About Taxes and Cryptocurrency.