Crypto arbitrage as a automated trading strategy?

If you’re at all familiar with the stock market as you are with cryptocurrency, then you’ve more than likely heard of crypto arbitrage trading. You might even know that it can be a lucrative part of savvy crypto investor’s strategies, or may have even used it yourself in the past and been burned.

Financial markets are fast-paced, global, and constantly pushing creative traders to find any advantage they can when it comes to turning a profit on their investments. One way to do that is by applying the concept of arbitrage to the world of cryptocurrency trading.

In this primer, we’ll go over what exactly arbitrage is, why it can be a successful strategy in the cryptocurrency market, and how you can utilize it yourself with a HaasBot.

What is Cryptocurrency Arbitrage?

As we covered in a previous post, arbitrage is the strategic practice of using price discrepancies in the market to one’s advantage by simultaneously buying and selling an asset in two different exchange locations. If a trader buys stock in a widget company going for $45.48 USD on the New York Stock Exchange (NYSE), and sees the same stock being sold on the Japan stock exchange for the equivalent of $46.00 USD, they can sell off those assets and make a profit of .52 per stock.

The same thing can be done with cryptocurrencies.

The cryptocurrency markets are much more volatile and abundant than the fiat markets, meaning there are more possibilities for wide discrepancies in value between cryptocurrency exchanges and thus creating opportunities to execute effective trades.

A particular crypto coin might have a value of .45 Bitcoin (BTC) on Bittrex and .5 BTC on Binance; whoever bought and sold that coin could make a profit and keep making it until the market equalized or they ran out of their holdings of that particular coin.

The global nature of cryptocurrency trading, the current lack of regulation in the market, and the volatility in the value of certain coins make cryptocurrency trading a perfect opportunity for traders looking for cryptocurrency arbitrage opportunities.

There are five basic steps to determining an arbitrage path opportunity in the market:

- Collect order book data on each exchange for certain assets you would like to evaluate for arbitrage.

- Examine the buy and ask prices on each exchange for the asset or assets in question to see if you can find an overlap.

- Sell that asset or assets on the exchange where the price is higher and buy where the price is lower, as close to simultaneously as possible.

- Continue to buy where the asset is low and sell where it’s high until you consume the order book.

- Once the entire opportunity has been used up, stop buying and selling that asset.

There are 20 major fiat stock exchanges around the world. As of this writing, there are over 200 cryptocurrency exchanges and HaasOnline supports 25 of the biggest exchanges. Different countries have different regulatory environments and restrictions, which can affect price enormously, leaving them wide open to arbitrage strategies, including inter-exchange arbitrage.

Triangular Arbitrage

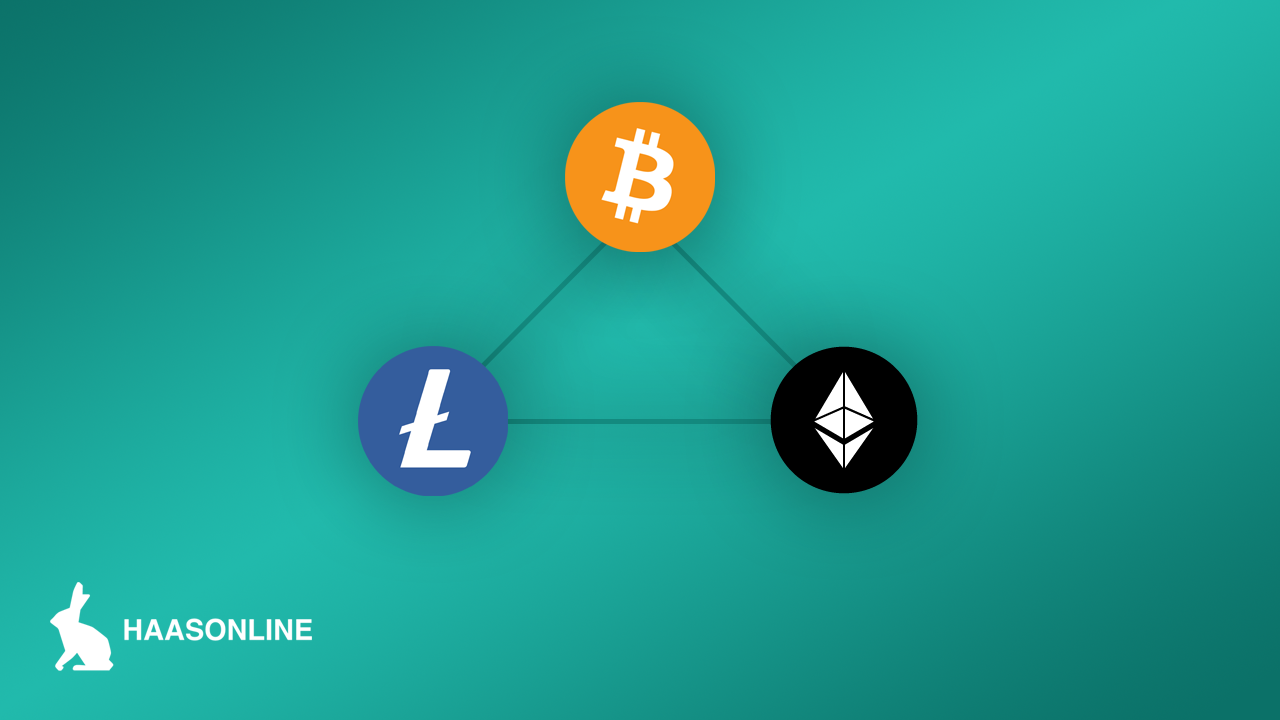

What we just described above is known as simple arbitrage: you buy one asset for lower and sell it for higher on a different exchange. But there’s another, more complicated kind of strategy called triangular arbitrage. This variation is commonly used in foreign exchange (forex) trading in fiat currency markets, and in some cases can be applied to cryptocurrency.

This strategy can happen either on a single exchange or across multiple exchanges when a price discrepancy between three different cryptocurrencies creates an opportunity. Moving through those three assets in a cycle can turn a profit when executed under ideal circumstances.

Say for example that the ETH to BTC exchange rate is favorable, and a trader has BTC to sell. They could trade their BTC for an intermediary cryptocurrency like Litecoin (LTC), then trade the LTC for ETH, then trade the ETH back to BTC for a net profit.

There are four steps to this strategy:

- Start with a single asset you want to increase in value. This will be the one you return to at the end of the cycle. We’ll use BTC as an example here.

- Trade that asset for one connected to both your original asset (BTC) and the next asset in the cycle, say BTC for Litecoin (LTC).

- Next, trade that asset for a third asset with connections to the first (BTC) and the one you’re currently trading (LTC). We’ll trade our LTC for ETH in this example.

- Convert the third currency (ETH) back to the original asset (BTC) at a favorable exchange rate.

We used LTC here because BTC could be traded for it, and it could be traded in turn for ETH. Once we traded the LTC for ETH, the ETH could be traded again for our original asset, BTC. All three trading pairs existed on that exchange, so we could take advantage of those trades. Because of the differences in buy/ask prices between those assets, we end up making a net profit and increasing BTC holdings.

Because the trader ultimately ends up increasing their original asset holdings, this is considered a low-risk strategy. In the forex world, these opportunities don’t last very long, but in the cryptocurrency market, exchange rates can vary widely and aren’t always updated as quickly as they are on traditional platforms. That means more opportunities that can also last longer. However, it should also be noted that settlement and trade execution times vary widely from exchange to exchange so you need to do due diligence in order to prevent opening yourself up to unforeseen risk.

How HaasOnline’s Technology Can Help

With hundreds of exchanges operating worldwide, constantly monitoring the cryptocurrency market for opportunities can be taxing. You could end up spending most of your time just looking for a path of opportunities and end up missing out on short-lived opportunities instead of turning a profit. That’s why some people choose to use crypto arbitrage bots.

Trading bots are faster at scanning the market for discrepancies and executing your strategy on the identified path than is humanly possible, and speed is key when it comes to this trading strategy. Our software operates continuously, so your bots can be scanning the market and executing trades around the clock.

The Takeaway

Arbitrage could be a useful trading strategy for experienced traders when executed on a single exchange or across multiple exchanges, in a wide-array of market conditions. It’s a relatively low-risk strategy for the experienced trader, but not entirely riskless; if you’re trading manually and don’t sell your assets quickly enough, you could be stuck holding bags with undervalued or toxic assets you didn’t want to long.

A couple ways to improve your results are to make sure you have the best connection to your desired exchange(s) on a high-performance machine with a stable broadband connection (or better). Make sure to calculate the average settlement time between exchanges to ensure you know how long it will take to manually settle your balances.

If you do it right, especially with the use of our trade automation either through our custom trade bots or by developing your own HaasScript, you can execute your strategy effectively.