How to Calculate Crypto Trading Profit

Accurate P&L Tracking

Track profit and loss across all trades with precise calculations including fees.

Portfolio Performance

Monitor overall portfolio returns across multiple exchanges and strategies.

Fee Analysis

See exactly how much you're paying in trading fees and their impact on returns.

Historical Data

Review past performance to identify winning strategies and costly mistakes.

Real-Time Updates

Get instant profit calculations as trades execute throughout the day.

Tax Reporting

Export detailed transaction history for accurate tax reporting and compliance.

Understanding the math behind profit

For spot trading: Profit = (Sell Price - Buy Price) × Amount - Fees. If you bought 1 BTC at $40,000 and sold at $45,000 with $50 in fees, your profit is ($45,000 - $40,000) × 1 - $50 = $4,950.

For leveraged trading, multiply by your leverage and account for funding rates. A 10x leveraged position magnifies both gains and losses. Margin trading adds complexity with liquidation risks and borrowing costs.

The hidden costs of trading

Trading fees typically range from 0.1% to 0.5% per trade, meaning a round-trip (buy + sell) costs 0.2% to 1%. On a $10,000 trade, that's $20-$100 in fees alone. High-frequency traders can pay thousands monthly in fees.

Slippage occurs when your order executes at a different price than expected, especially in volatile markets or with large orders. Market orders suffer more slippage than limit orders. These hidden costs significantly impact profitability.

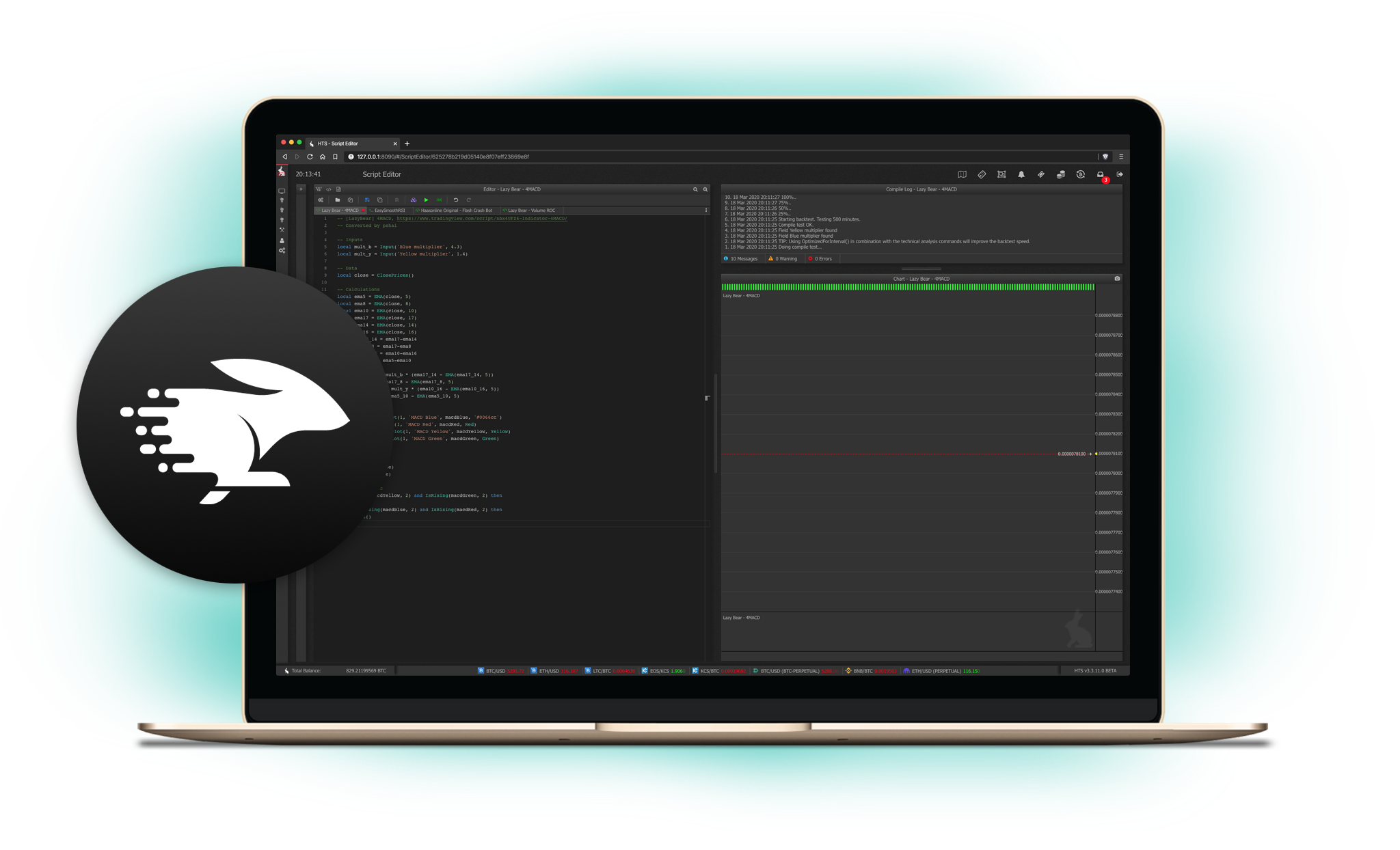

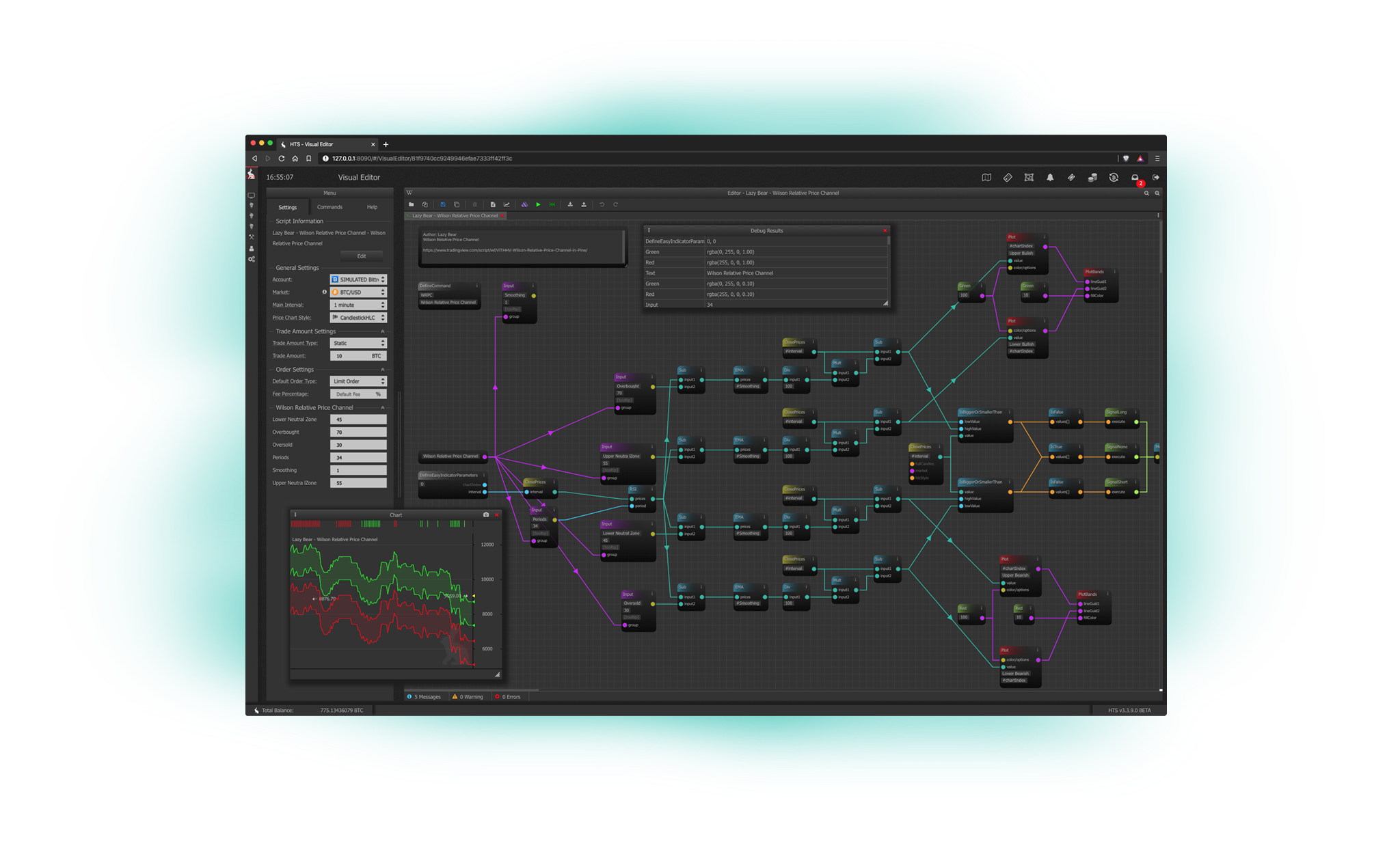

Let software do the calculations

Trading platforms like HaasOnline automatically calculate profits, track fees, and generate performance reports. See win rate, average profit per trade, maximum drawdown, and ROI across all strategies and exchanges.

Automated tracking eliminates manual spreadsheet errors and provides real-time insights. Compare bot performance, identify your best strategies, and spot problems before they drain your account. Export reports for taxes and analysis.

Frequently Asked Questions

Explore automated trading tools

Standard Upgrade. Completely Free. Unrestricted Trial.

Track your trading performance with automated profit calculations, fee analysis, and portfolio reporting. Get a free 3-day trial with full access to all features. No credit card required.