What is a Crypto Trading Bot?

Trade 24/7/365

Automate strategies and trade around your schedule, day or night.

Reduce Mistakes

Trade without letting emotions affect your strategy execution.

Speed & Precision

Execute trades in milliseconds and capture market opportunities.

Track More Markets

Monitor dozens of trading pairs across multiple exchanges.

Backtest Strategies

Test strategies on historical data before risking real money.

Stay Consistent

Execute the same strategy every time without second-guessing.

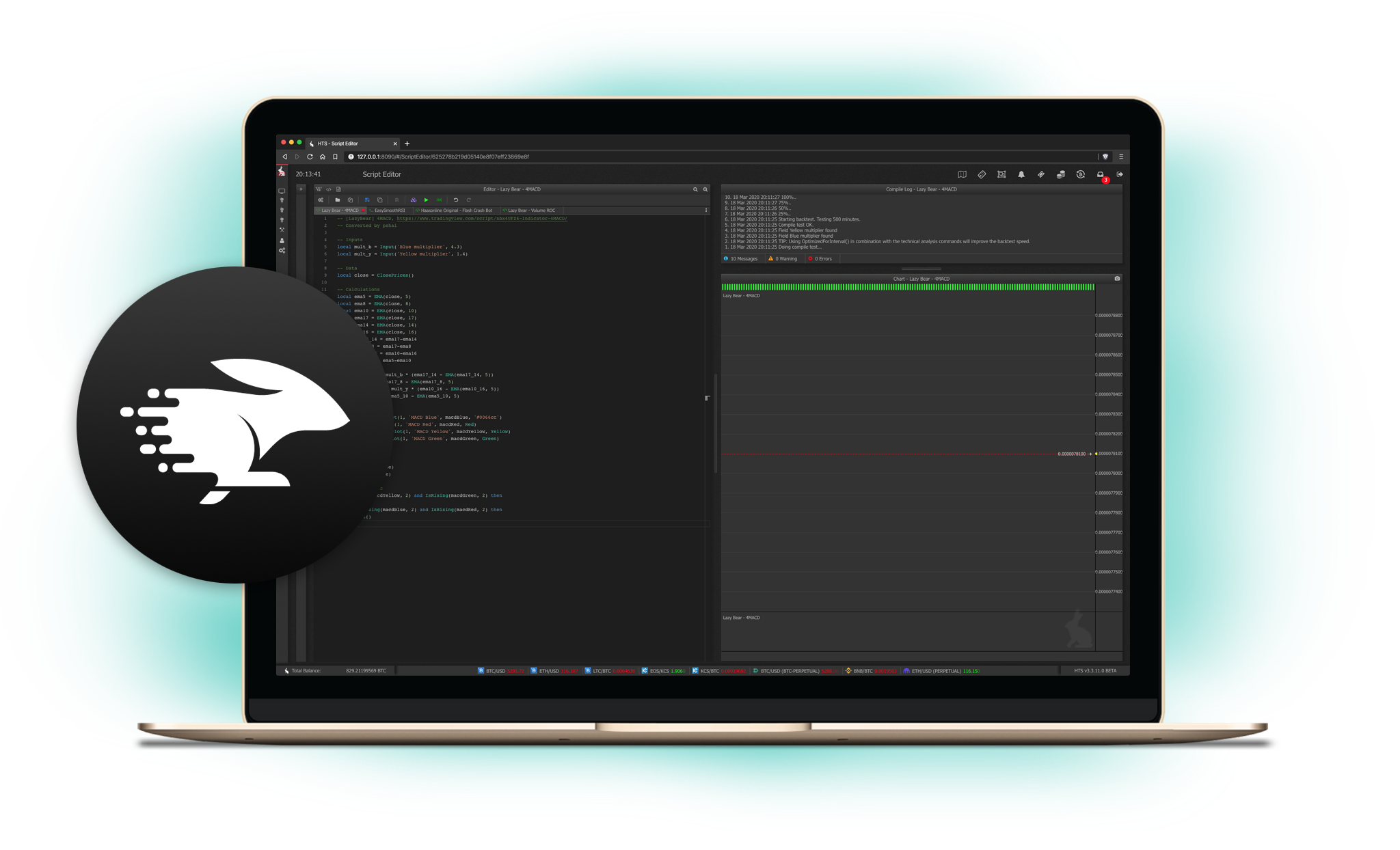

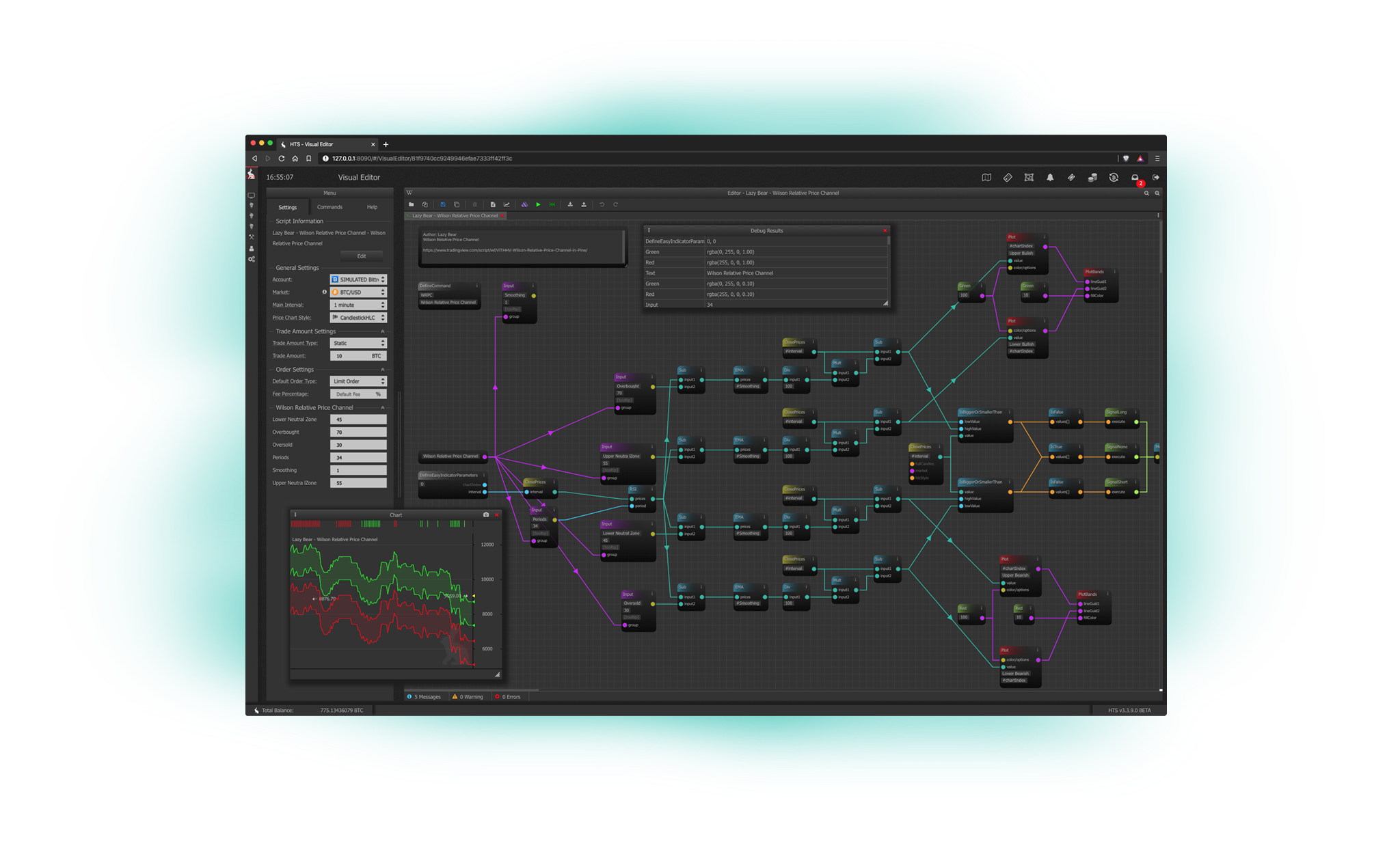

How do crypto trading bots work?

Crypto trading bots connect to your exchange through API keys (read and trading permissions only). The bot continuously monitors market data, analyzes price movements using indicators and algorithms, and automatically executes trades when conditions match your strategy.

Your cryptocurrency always remains in your exchange account under your control—bots never hold your funds. This non-custodial approach keeps you in complete control of your assets.

Types of crypto trading bots

Different trading bots suit different market conditions. Grid trading bots operate in sideways markets by placing buy/sell orders at preset intervals. DCA bots accumulate cryptocurrency gradually over time. Arbitrage bots exploit price differences between exchanges.

HaasOnline offers pre-built templates for all major strategies, plus the ability to create custom bots using HaasScript for advanced traders.

Grid Trading Bot

DCA Bot

Arbitrage Bot

Bitcoin Trading Bot

Custom Strategies with HaasScript →

Are crypto trading bots safe?

Crypto trading bots are safe when using reputable non-custodial platforms like HaasOnline. Your funds remain in your exchange account—bots connect via API with trading permissions only (never withdrawal permissions).

However, bots are tools, not magic money-makers. Use stop losses, start with paper trading to test strategies risk-free, and never invest more than you can afford to lose. Successful bot trading requires proper strategy, risk management, and ongoing monitoring.

Frequently Asked Questions

Explore crypto bot strategies

Standard Upgrade. Completely Free. Unrestricted Trial.

Start automated crypto trading today. Get a free 3-day trial with full access to all bot strategies, backtesting, and features. No credit card required.