What is a DCA Bot?

Remove Emotion

Automate purchases and avoid fear-driven decisions during market swings.

No Market Timing

Buy consistently without stress about finding the "perfect" entry point.

Smooth Volatility

Average your purchase price over time, reducing impact of price spikes.

Build Long-Term

Accumulate assets gradually for long-term holding strategies.

Set and Forget

Configure once and let the bot execute automatically on schedule.

Flexible Budget

Start with any amount and adjust frequency to match your budget.

Buy the same amount, consistently

DCA bots place buy orders for fixed dollar amounts at regular intervals—regardless of current price. When prices are high, you buy less crypto. When prices are low, you buy more. This averages out your cost basis over time.

Instead of investing $1,000 all at once (risking buying at a local peak), DCA spreads purchases over time. For example: $100 weekly for 10 weeks. This reduces the risk of poor timing and smooths out volatility impact.

Perfect for long-term investors

DCA works best when you believe in long-term appreciation but don't want to risk buying at peak prices. Use it for assets you plan to hold for months or years, not for short-term trading. Ideal during uncertain markets when timing feels impossible.

DCA reduces psychological stress. You don't agonize over "should I buy now?" or panic during crashes. The bot buys automatically on schedule, accumulating positions without emotional interference. Perfect for investors with regular income to invest.

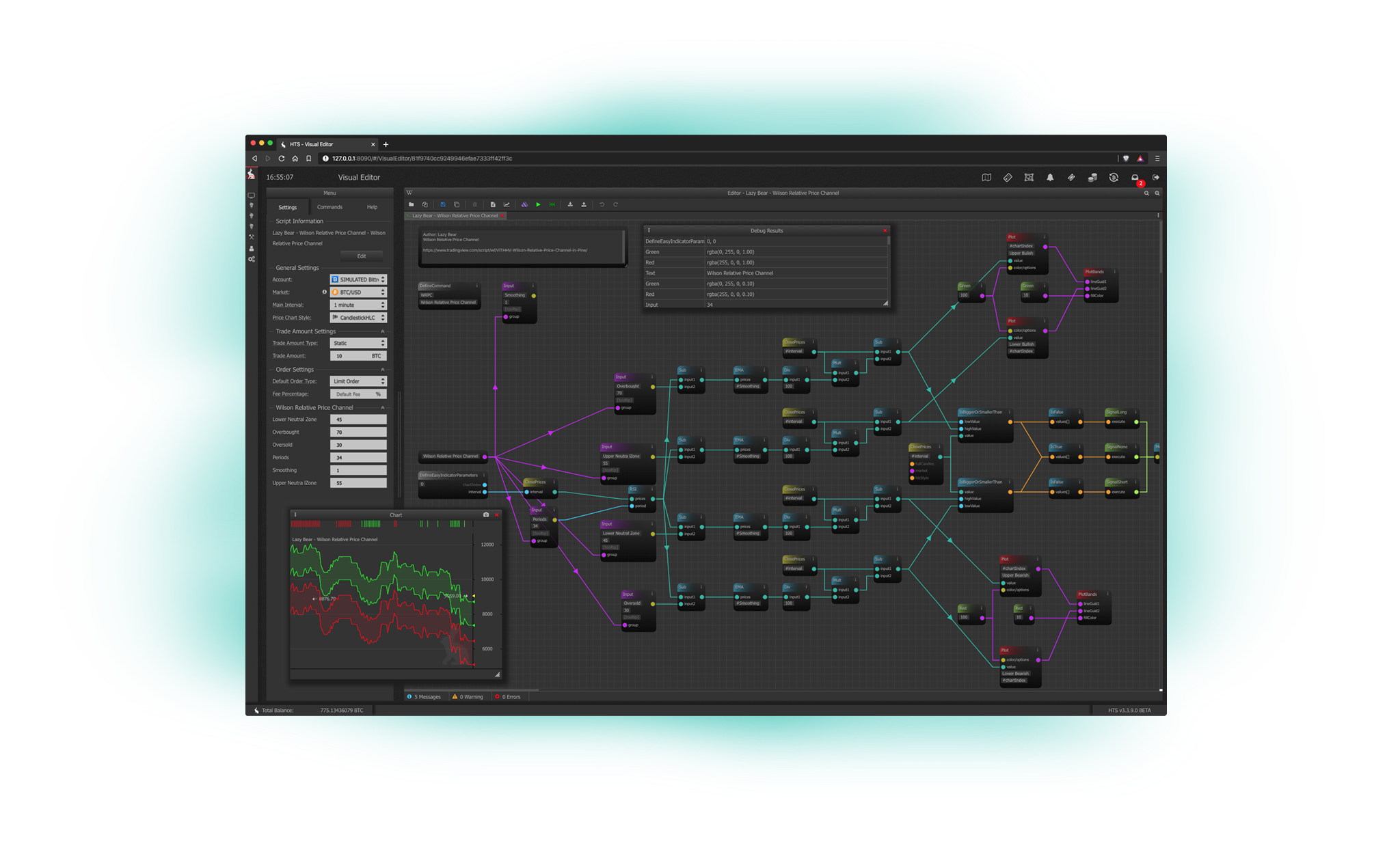

Simple setup, powerful results

Configure your DCA bot by setting purchase amount ($50, $100, $500, etc.), frequency (daily, weekly, biweekly, monthly), and which asset to buy. The bot executes automatically on schedule, buying at market price each interval.

Advanced configurations include price deviation limits (skip purchases if price spikes above threshold), take-profit targets (sell portions after x% gain), and stop-loss protection. Start simple, add complexity as you gain experience.

Frequently Asked Questions

Explore more crypto bot strategies

Standard Upgrade. Completely Free. Unrestricted Trial.

Start building your crypto portfolio with automated DCA. Get a free 3-day trial with full access to all strategies and features. No credit card required.