What is a Crypto Arbitrage Bot?

Market Neutral Strategy

Trade price differences without predicting market direction or trends.

Fast Execution

Capture opportunities in seconds before price differences disappear.

All Market Conditions

Execute trades in bull markets, bear markets, and sideways conditions.

Systematic Execution

Exploit recurring inefficiencies across fragmented crypto exchanges.

Automated Scanning

Monitor dozens of exchanges and trading pairs simultaneously.

Reduced Exposure

Hold positions for seconds or minutes, not hours or days.

Buy low, sell high—across exchanges

Arbitrage bots continuously monitor prices across multiple exchanges. When they detect a price difference (spread) that exceeds trading fees, they simultaneously buy on the cheaper exchange and sell on the more expensive exchange.

The entire process takes seconds. You need balances on multiple exchanges to execute quickly without waiting for transfers. Bots scan hundreds of trading pairs, identifying opportunities humans would miss.

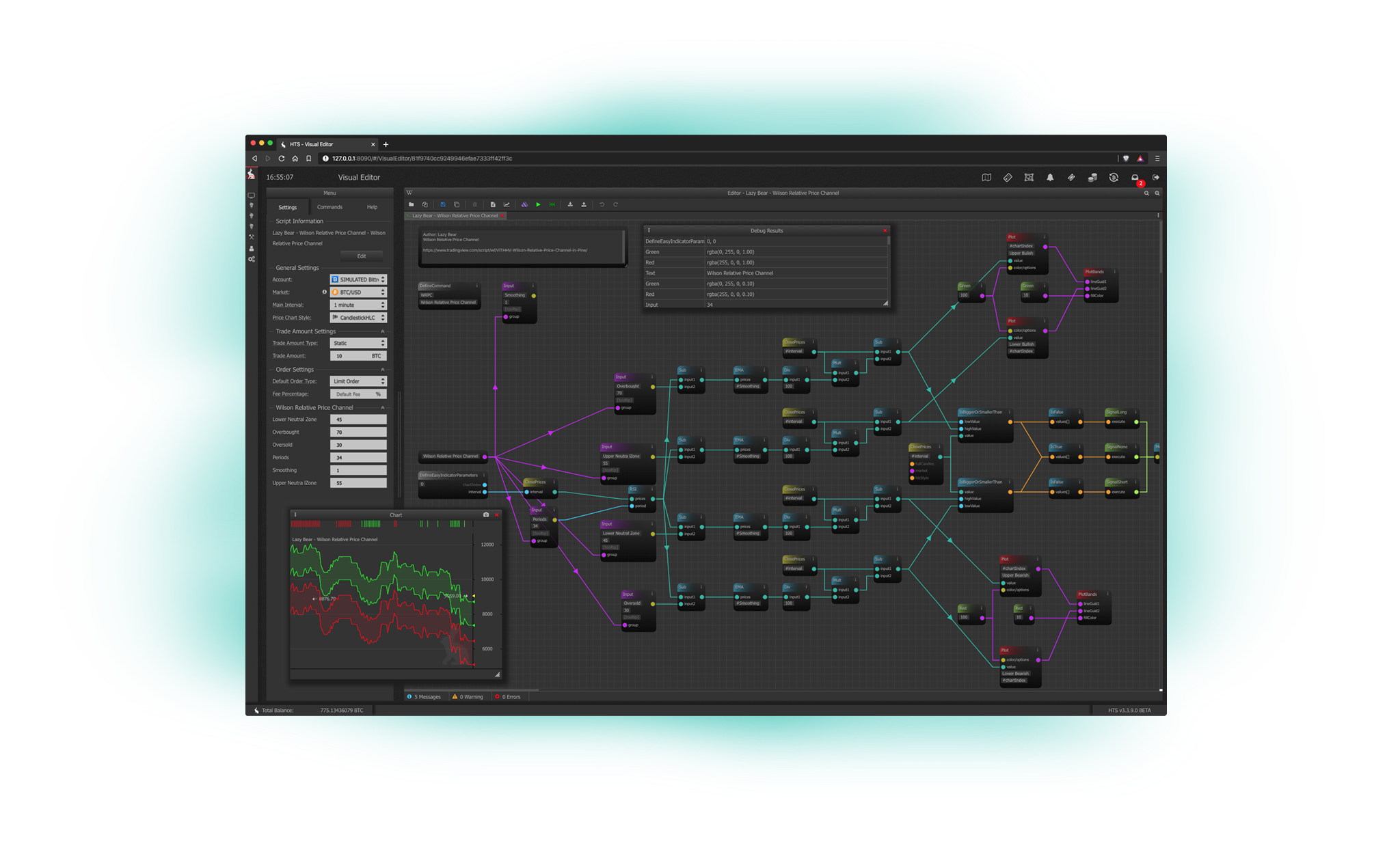

Multiple arbitrage strategies

Spatial arbitrage exploits price differences between exchanges for the same trading pair. Triangular arbitrage trades three different pairs on one exchange to capture pricing inefficiencies. Statistical arbitrage uses historical price relationships to predict temporary mispricings.

Different strategies suit different market conditions and capital levels. Spatial arbitrage is simplest for beginners, while triangular arbitrage doesn't require transferring funds between exchanges, reducing execution risk.

What you need to succeed

Successful arbitrage requires balances on multiple exchanges (minimum $1000-$2000 spread across 2-3 exchanges), fast execution speed (opportunities disappear in seconds), and low trading fees (high fees eat into slim profit margins).

Choose exchanges with high liquidity, reliable uptime, and reasonable withdrawal limits. Automated bots are essential—human traders can't scan dozens of exchanges and execute trades fast enough to capture opportunities.

Frequently Asked Questions

Standard Upgrade. Completely Free. Unrestricted Trial.

Start arbitrage trading with automated cross-exchange scanning and execution. Get a free 3-day trial with full access to all strategies and features. No credit card required.