What is a Bitcoin Trading Bot?

24/7 Bitcoin Trading

Never miss opportunities in Bitcoin's always-on global market.

Remove Emotion

Execute strategies with discipline, avoiding panic sells and FOMO buys.

Multiple Strategies

Grid trading, DCA, trend following, and more for all market conditions.

Lightning Execution

React to Bitcoin price movements in milliseconds, not minutes.

Backtesting

Test strategies on years of Bitcoin history before risking capital.

Non-Custodial

Your Bitcoin stays in your exchange account under your control.

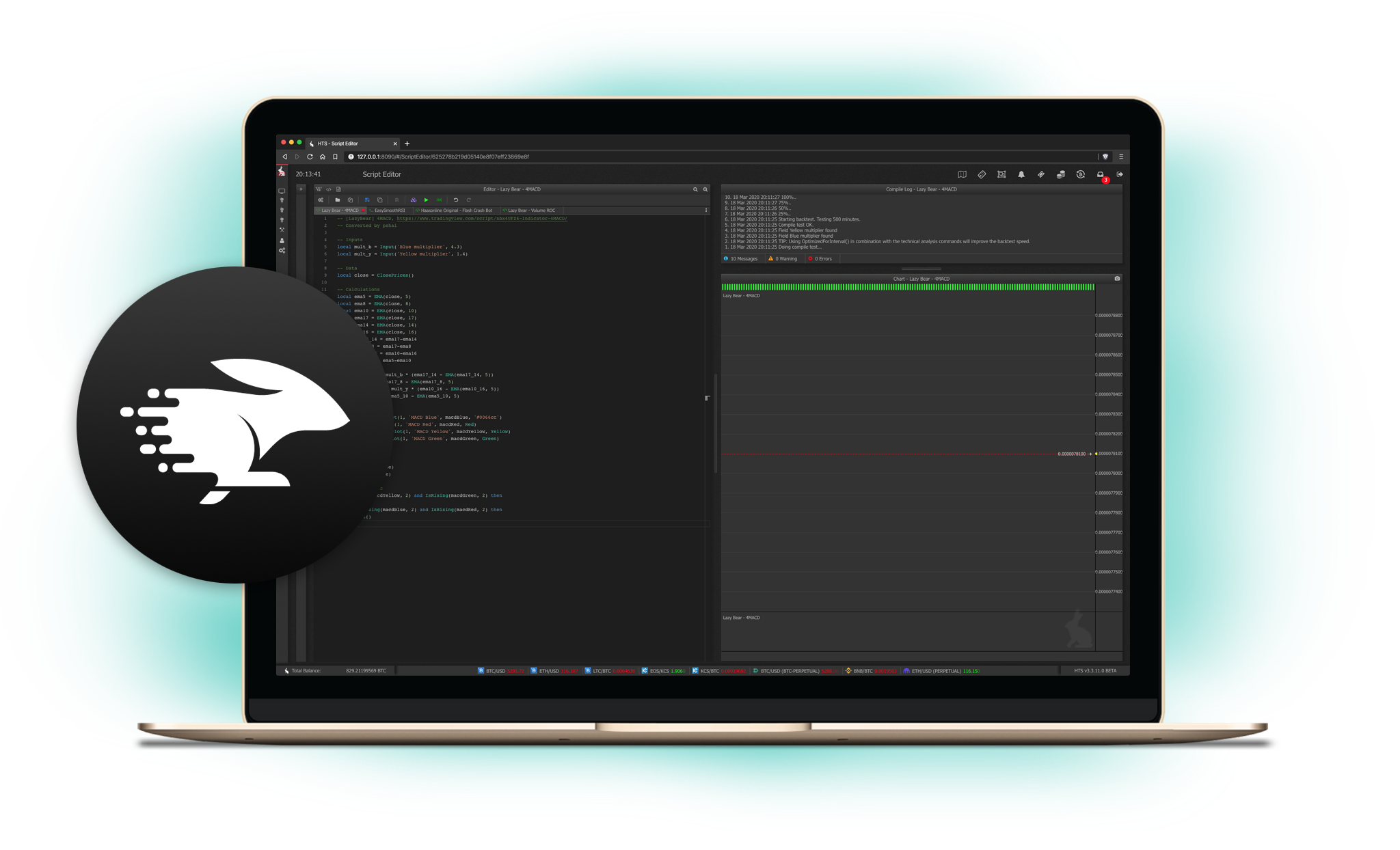

Automate your BTC trading strategy

Bitcoin trading bots connect to your exchange via API keys (read and trading permissions only). The bot continuously monitors Bitcoin price, analyzes movements using technical indicators, and automatically executes trades when conditions match your strategy.

Your Bitcoin always remains in your exchange account under your control—bots never hold your funds. This non-custodial approach keeps you in complete control while automating execution. Set up once, let the bot trade continuously.

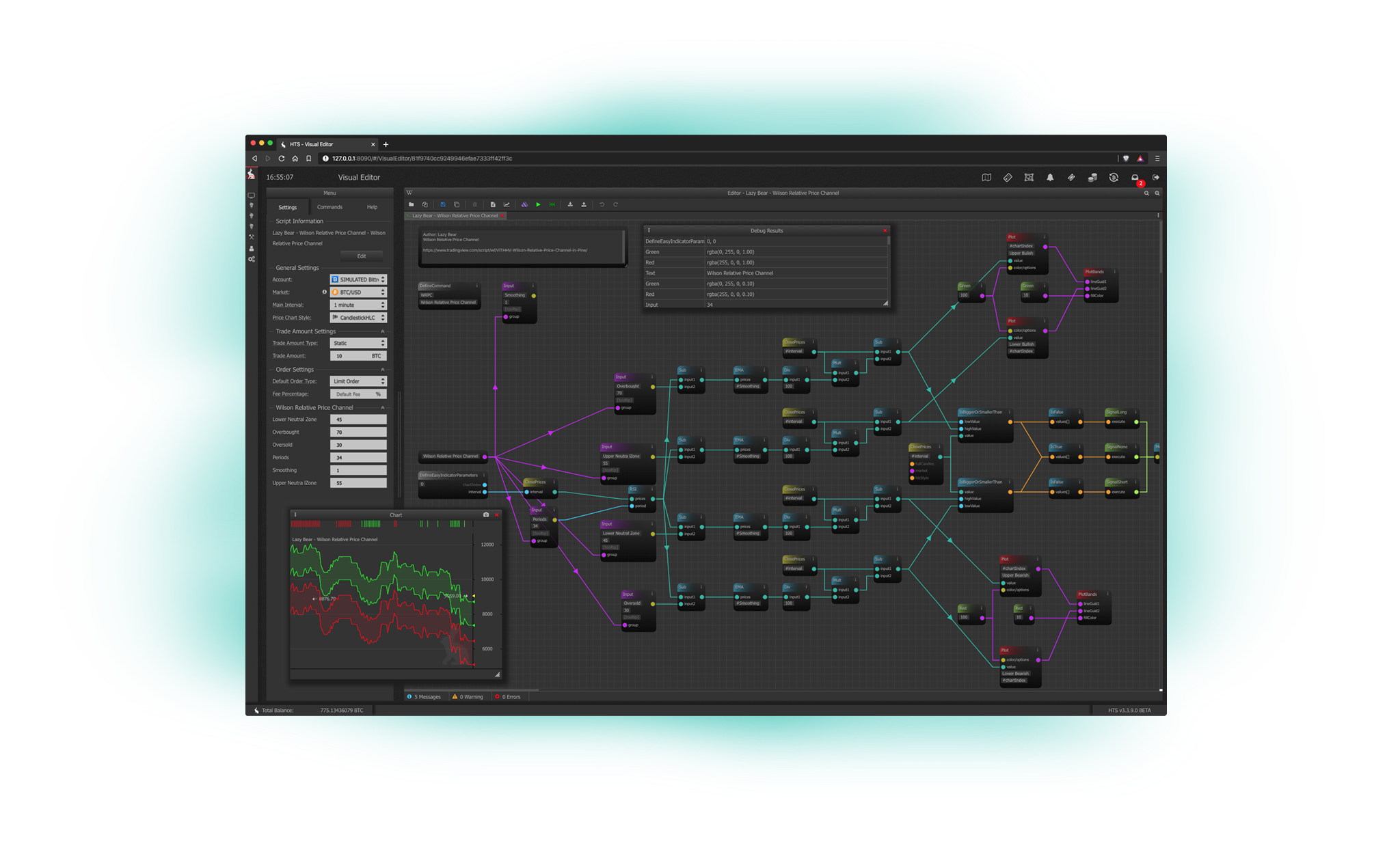

Different strategies for different markets

Grid trading bots operate in Bitcoin's ranging markets with volatility. DCA bots accumulate BTC gradually for long-term holders. Trend following bots ride Bitcoin bull and bear markets. Mean reversion bots exploit price extremes with quick execution.

The best strategy depends on current market conditions and your goals. Bitcoin's 24/7 nature and high liquidity make it ideal for automated trading. Use multiple strategies simultaneously or switch based on market regime.

Keep your Bitcoin secure

Bitcoin trading bots are safe when using reputable non-custodial platforms. Your BTC remains in your exchange account—bots connect via API with trading permissions only, never withdrawal permissions. Use two-factor authentication and API key restrictions.

Start with paper trading to test strategies risk-free. Use stop losses to limit downside. Never share API keys or enable withdrawal permissions. HaasOnline never holds your Bitcoin—you maintain full custody at all times.

Frequently Asked Questions

Standard Upgrade. Completely Free. Unrestricted Trial.

Start automated Bitcoin trading with strategy templates and pre-built frameworks. Get a free 3-day trial with full access to all bot strategies and features. No credit card required.