What is a Grid Trading Bot?

Trade Volatility

Execute trades around price swings without predicting market direction.

Hands-Off Trading

Set your grid parameters once and let the bot trade automatically.

Risk Management

Define your price range upfront and control exactly how much you risk.

Ranging Markets

Designed for sideways markets with defined price ranges.

Multiple Positions

Buy and sell across multiple price levels to maximize opportunities.

Systematic Execution

Each completed grid cycle automatically reinvests to the next level.

Buy low, sell high—automatically

Grid trading divides a price range into equal intervals (grid levels). The bot places buy orders below current price and sell orders above. When price moves through the grid, orders execute automatically.

When a buy order fills, the bot immediately places a sell order at the next grid level above. This repeats continuously, executing trades systematically around price oscillations in ranging markets.

Perfect for sideways markets

Grid trading is designed for ranging or sideways markets where price oscillates within a predictable range. Use it during consolidation periods after major moves, on pairs with moderate volatility, and when no clear trend is forming.

Avoid grid trading during strong trending markets, major news events, or when price is breaking out of established ranges. The strategy assumes mean reversion—price returns to average rather than trending strongly in one direction.

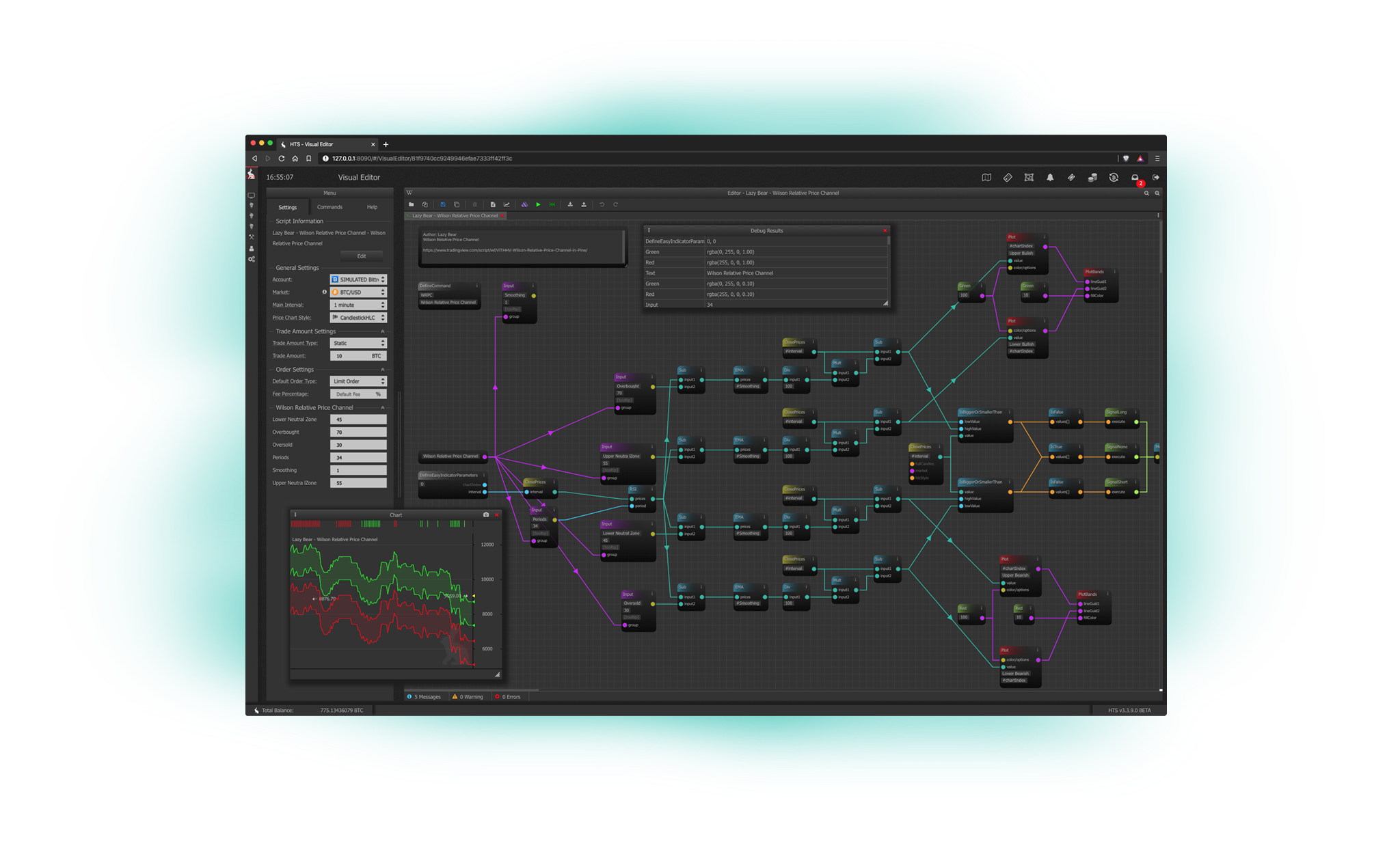

Configure your grid parameters

Set your price range (upper and lower bounds), number of grid levels (determines spacing), and investment amount. More grid levels mean tighter spacing and more frequent trades. Wider spacing reduces trade frequency but captures larger moves.

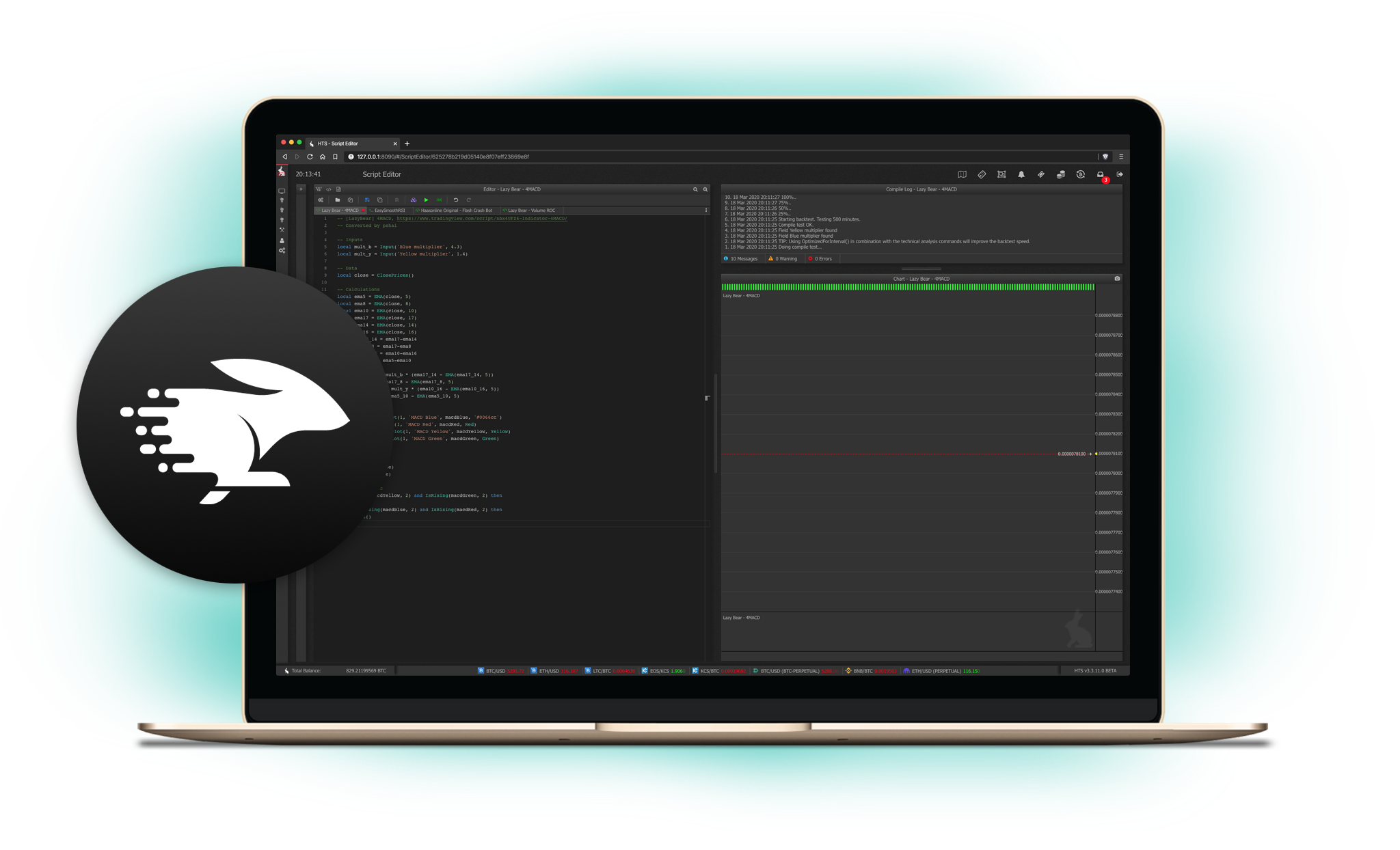

HaasOnline's visual grid builder shows your grid overlay on price charts, making setup intuitive. Backtest different configurations against historical data to find optimal settings before going live.

Frequently Asked Questions

Standard Upgrade. Completely Free. Unrestricted Trial.

Start grid trading today with pre-built templates and visual configuration. Get a free 3-day trial with full access to all strategies and features. No credit card required.