Flash Crash Bot: Automated Extreme Dip Buying

Capture Extreme Dips

Buy during panic-driven flash crashes when assets become severely oversold.

Quick Recovery Profits

Capitalize on rapid rebounds that typically follow extreme selloffs within minutes or hours.

Liquidation Cascades

Profit from forced selling during mass liquidations on leveraged positions.

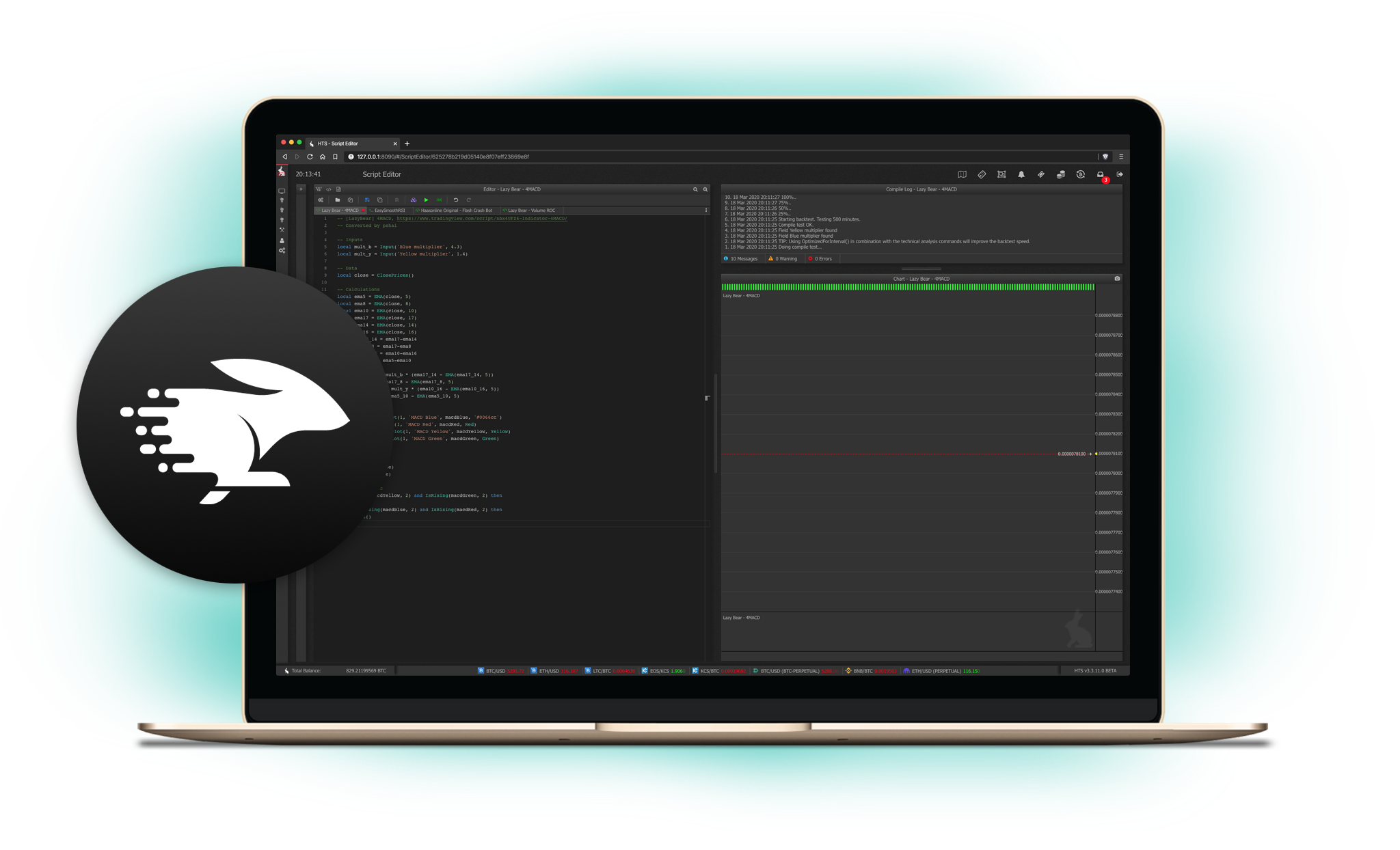

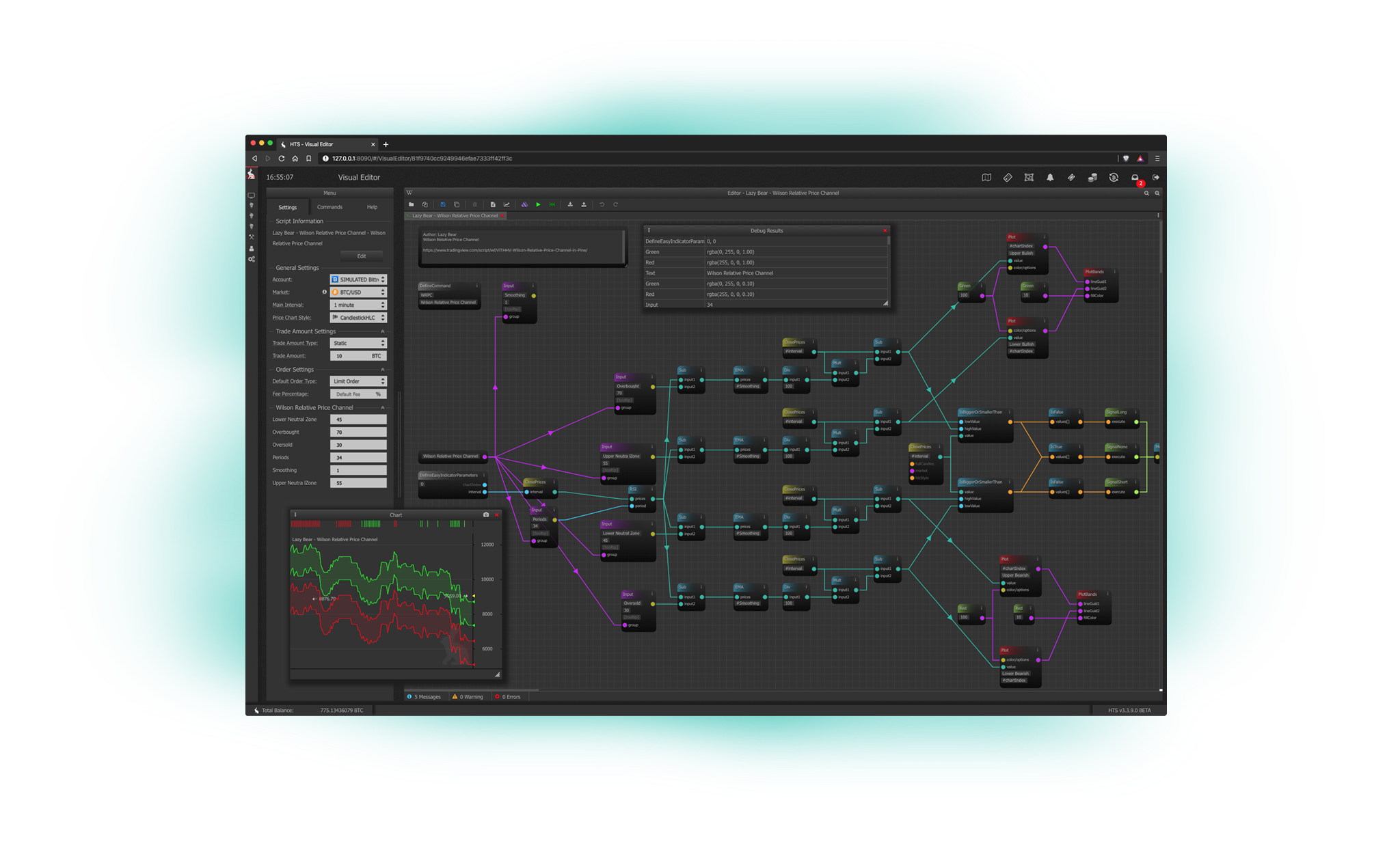

Automated Detection

Bots monitor for crash conditions 24/7 and execute instantly when criteria are met.

Risk Management

Strict stop losses prevent catching falling knives during genuine sustained downtrends.

Contrarian Strategy

Buy when others panic-sell—one of the most profitable but psychologically difficult strategies.

Buy fear, sell recovery

Flash crashes occur when price drops sharply within minutes due to cascading liquidations, whale dumps, exchange outages, or stop loss triggering. Panic sellers create temporarily depressed prices. Flash crash bots detect these conditions using volatility indicators, RSI divergence, volume spikes, or percentage drops from recent highs.

When a crash is detected, the bot buys at predetermined levels. As panic subsides and price rebounds, the bot sells at target recovery levels. Execution timing and risk management are critical, as not all crashes recover quickly. There are no guarantees, and losses can occur if the crash continues.

Identifying tradeable flash crashes

Not all crashes are flash crashes—some are the start of prolonged downtrends. Tradeable flash crashes show extreme RSI readings (under 20-25), massive volume spikes indicating forced liquidations, rapid percentage drops (5-15% in under 30 minutes), and price deviation from moving averages exceeding 2-3 standard deviations.

Look for wicks on candlesticks—long lower wicks suggest buyers stepped in aggressively at lower levels. Order book analysis reveals if selling pressure was temporary (order book recovers quickly) or fundamental (sustained low bids). Exchange funding rates on perpetuals spike negative during liquidation cascades—a signal that long positions were wiped out.

Avoid catching falling knives

The biggest risk is buying a "falling knife"—what looks like a flash crash is actually the beginning of a major bear move. Use tight stop losses (3-5% below entry) to limit damage if price doesn't recover. Scale into positions rather than going all-in immediately—buy 30% on initial crash, 30% more if it dips further, keep 40% in reserve.

Set profit targets for partial exits—sell 50% at first resistance, let the rest run for potential full recovery. Time-based exits are crucial—if price hasn't recovered within 4-6 hours, something is fundamentally wrong. Exit even at a loss rather than hoping for recovery that may never come. Never use high leverage on crash trades—volatility can trigger liquidations even when your direction is correct.

Frequently Asked Questions

Explore other bot strategies

Automated Crash Trading. Completely Free Trial. No Credit Card Required.

Profit from extreme market dips with flash crash bots that automatically buy panic sell-offs and capture quick recoveries. Get a free 3-day trial with full access to all features.