Market Making Bot: Automated Crypto Liquidity Provider

Earn from Spreads

Profit from the difference between buy and sell prices by continuously providing liquidity to the market.

Automated Quoting

Automatically adjust bid and ask orders based on market conditions and inventory levels.

Risk Management

Built-in inventory controls prevent overexposure and maintain balanced positions across assets.

Multiple Pairs

Run market making strategies across multiple trading pairs simultaneously for diversification.

Spread Capture

Earn passive income by capturing the bid-ask spread on every completed round-trip trade.

24/7 Operation

Maintain continuous market presence without manual intervention, maximizing profit opportunities.

Provide liquidity and capture spreads

Market making bots place limit orders on both sides of the order book—buy orders below the current price and sell orders above it. When both orders fill, you profit from the spread between them. The bot continuously adjusts orders as the market moves.

For example, if Bitcoin is trading at $50,000, you might place a buy order at $49,900 and a sell order at $50,100. When both execute, you earn $200 per BTC traded (minus fees). The bot repeats this process thousands of times.

Protect your inventory

Effective market making requires careful inventory management. If you accumulate too much of one asset, you're exposed to directional risk. HaasOnline's market making bots include inventory controls to maintain balanced positions.

Set maximum position limits, adjust spread widths based on volatility, and configure skew parameters to lean orders toward reducing inventory imbalances. These features help you stay market-neutral and avoid losses from adverse price movements.

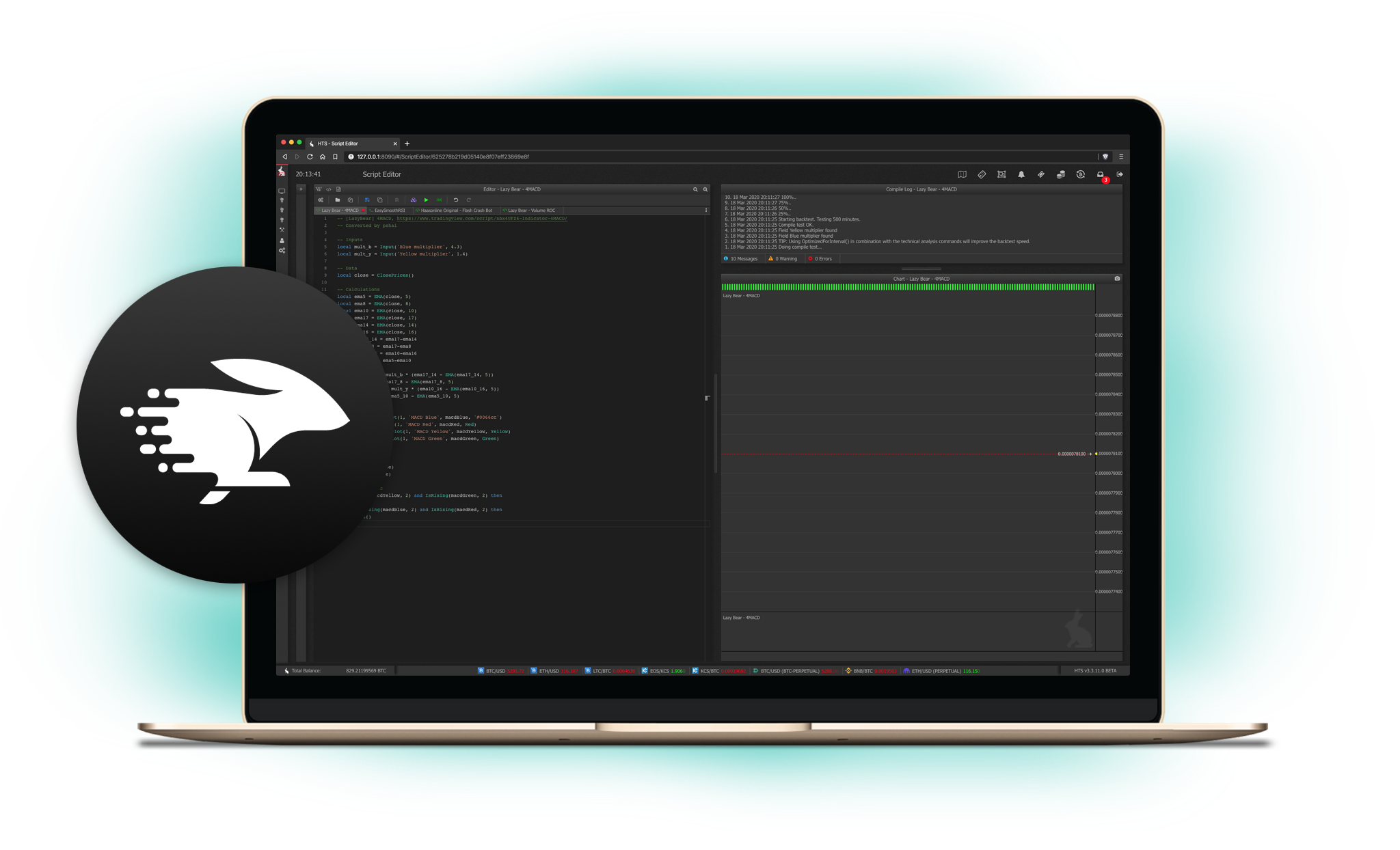

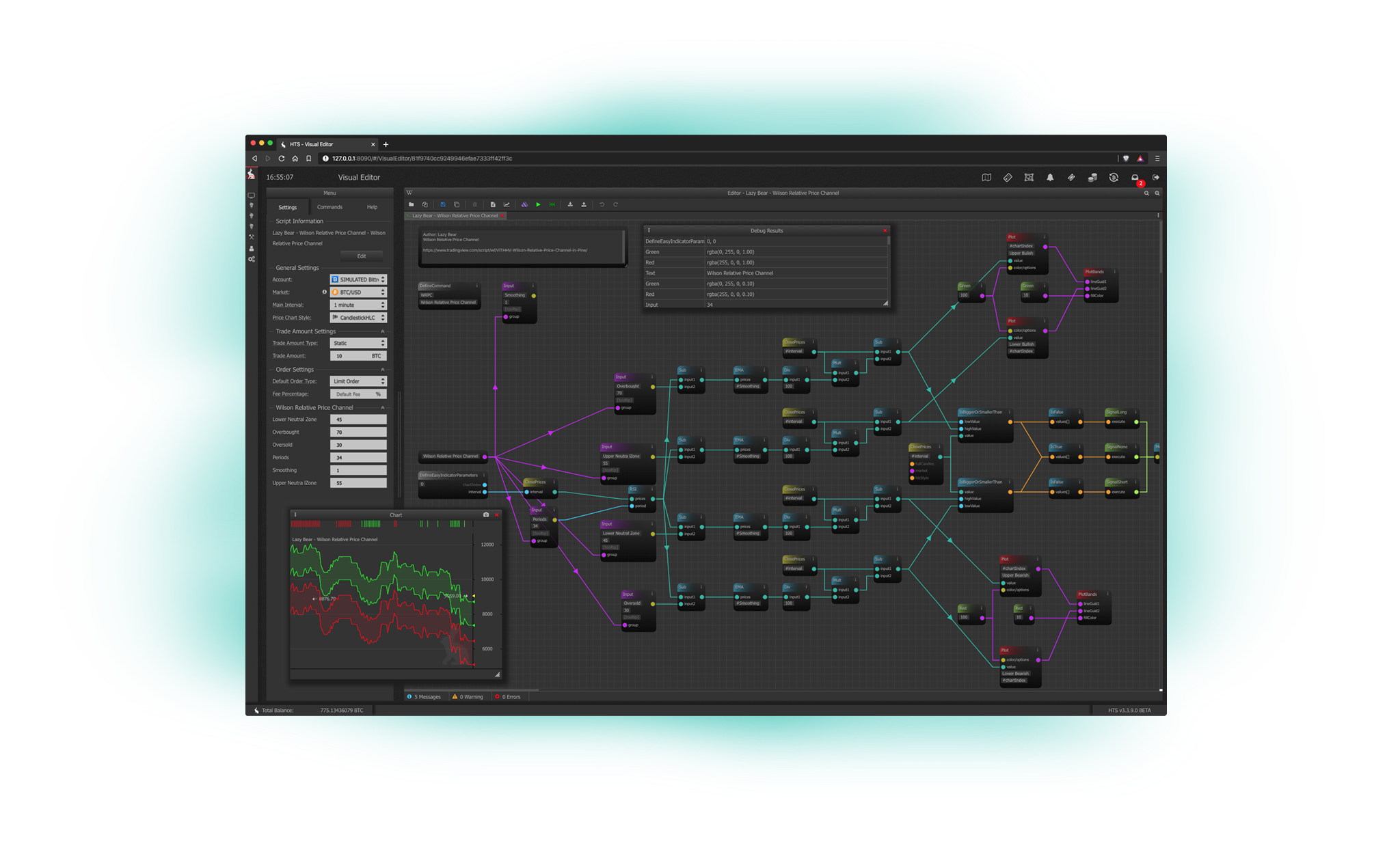

Professional market making tools

HaasOnline provides advanced features for serious market makers: dynamic spread adjustment based on volatility, order book depth analysis, inventory-aware order placement, and multi-pair coordination to maintain overall portfolio balance.

Backtest your strategies on historical data, optimize parameters for different market conditions, and deploy with confidence. Monitor real-time P&L, fill rates, inventory levels, and spread capture across all your market making activities.

Frequently Asked Questions

Explore other bot strategies

Professional Market Making. Completely Free Trial. No Credit Card Required.

Start providing liquidity and earning spreads with automated market making strategies. Get a free 3-day trial with full access to all features. Deploy professional market making bots in minutes.