Order Bot: Automated Sequential Order Execution

Sequential Execution

Execute orders in a predetermined sequence as each price target is reached.

Scale In/Out

Gradually build or exit positions across multiple price levels to get better average prices.

Set and Forget

Define your entire trading plan upfront and let the bot execute it automatically.

Price Level Control

Specify exact prices for each order to execute your strategy with precision.

Flexible Sizing

Configure different order sizes for each level to match your risk management needs.

24/7 Monitoring

Bot watches price levels continuously and executes orders even while you sleep.

Execute trading plans systematically

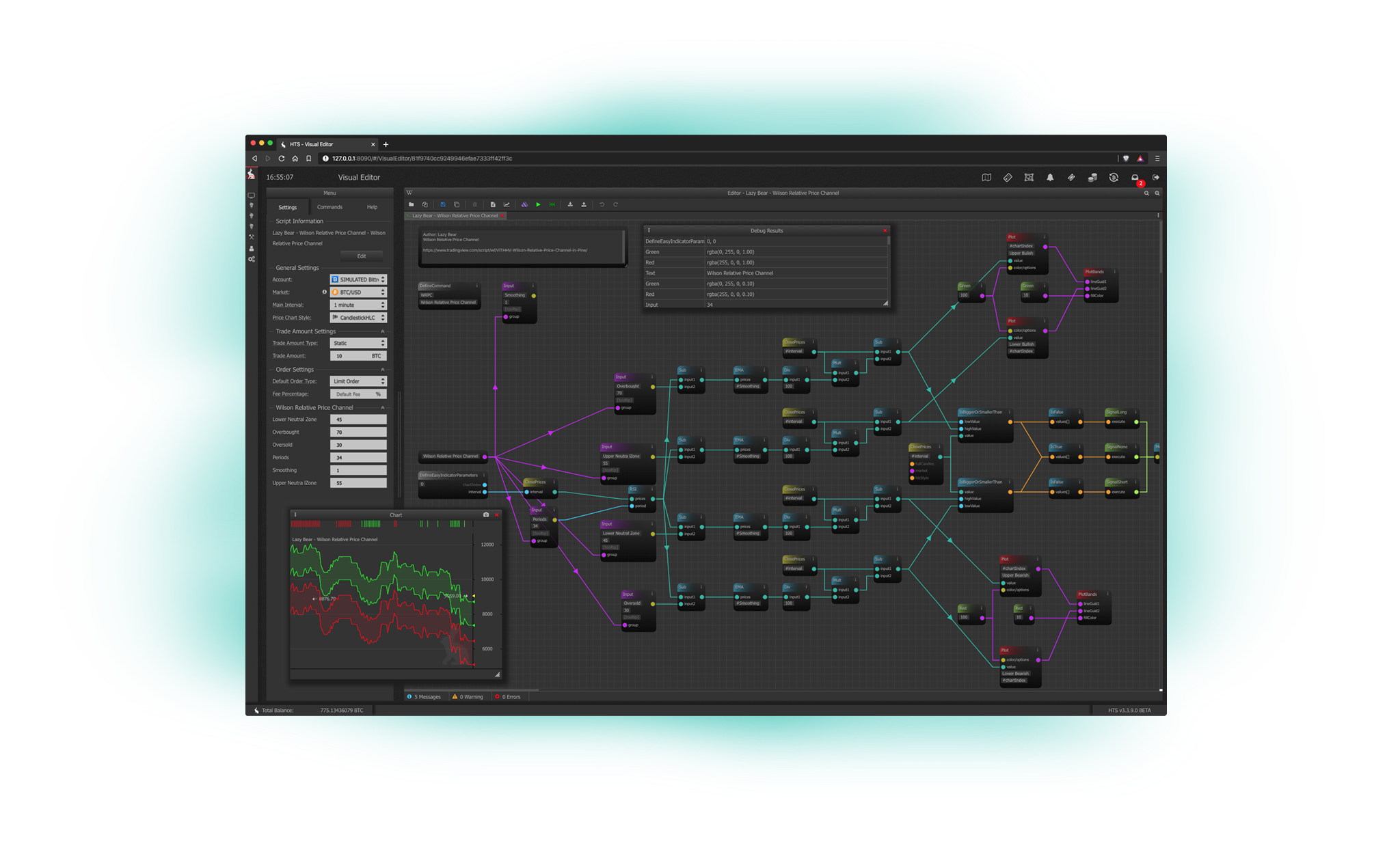

Order bots execute a list of orders sequentially as price levels are reached. For example, you might set buy orders at $45,000, $44,000, and $43,000 to scale into a Bitcoin position. The bot places the first order and monitors price. When filled, it places the next order automatically.

This is perfect for taking profits in stages ($51k, $52k, $53k) or entering positions gradually during dips. You define the entire sequence upfront—order types, prices, sizes, and conditions. The bot handles execution timing and order management.

Common order bot strategies

Take-profit ladders: Sell portions of your position at multiple resistance levels to maximize gains. Scale-in buying: Accumulate assets gradually during pullbacks to average down entry prices. Breakout trading: Place orders above resistance levels that execute when price breaks through.

Support/resistance plays: Set orders at key technical levels where reversals are likely. Range trading: Alternate buy and sell orders within a defined price channel. Complex exits: Implement sophisticated profit-taking strategies with multiple targets.

Fine-tune your execution

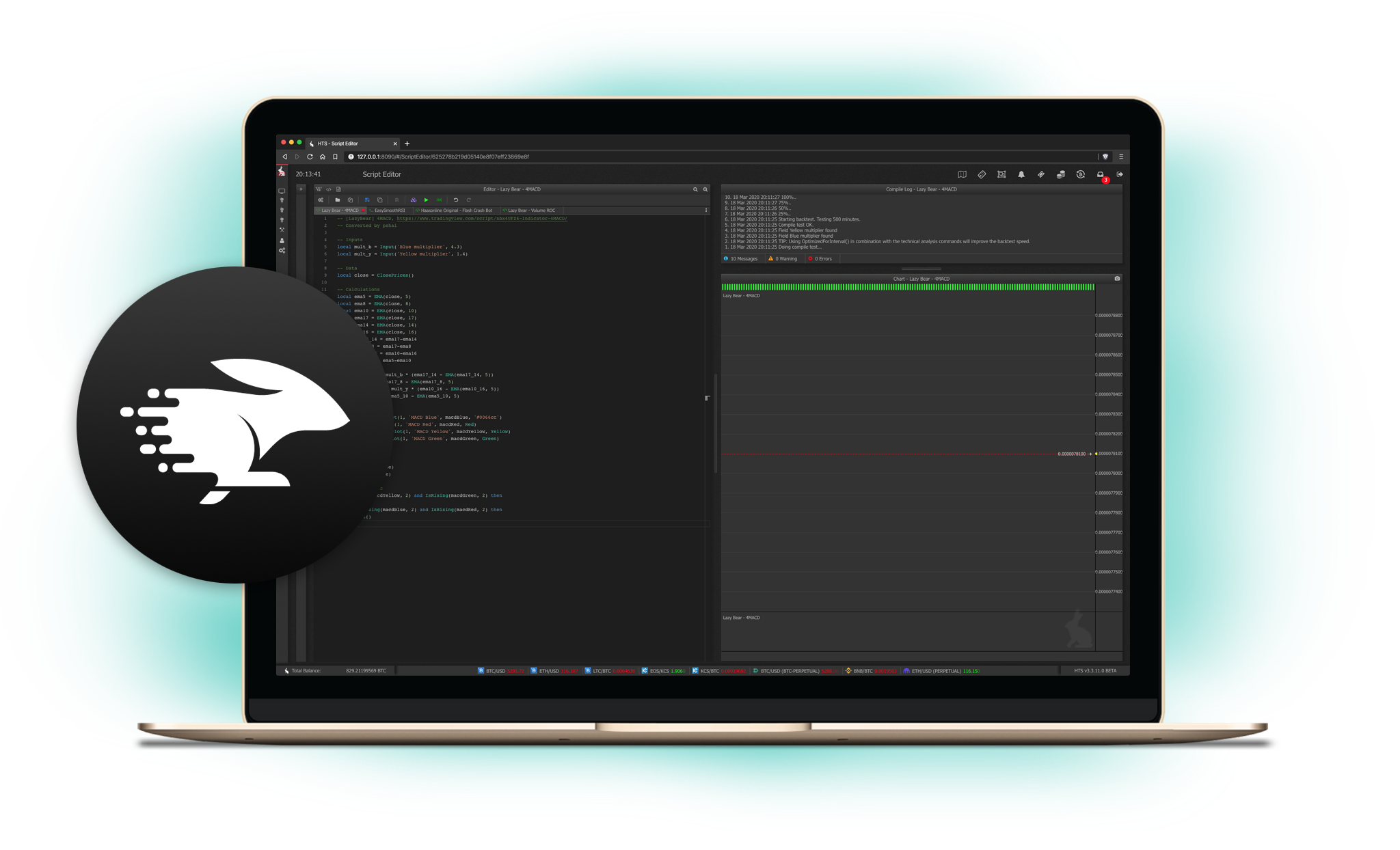

Configure order types (market, limit, stop-limit), expiration times, post-only flags, and conditional logic. Set time-based delays between orders or wait for confirmation signals. Use percentage-based sizing relative to portfolio or position size.

Combine with technical indicators to trigger order sequences only when conditions are met. Monitor execution via detailed logs showing which orders filled, at what prices, and remaining orders in the sequence. Adjust the plan mid-execution if market conditions change.

Frequently Asked Questions

Explore other bot strategies

Automated Order Execution. Completely Free Trial. No Credit Card Required.

Execute complex trading plans automatically with order bots. Define your sequence once and let the bot handle execution. Get a free 3-day trial with full access to all features.