Ping Pong Bot: Automated Range Trading

Range Trading

Profit from sideways markets by repeatedly buying low and selling high within defined boundaries.

Repeated Profits

Generate multiple winning trades from the same price range rather than waiting for breakouts.

Predictable Execution

Clear entry and exit levels based on support and resistance make strategy transparent.

Low Risk Per Trade

Small distances between entries and exits limit downside on individual positions.

Compound Returns

Reinvest profits from each cycle to grow position size and accelerate gains.

Flexible Ranges

Adapt to different market conditions by adjusting support and resistance boundaries.

Buy the dip, sell the rip

Ping pong bots identify a price range with clear support and resistance. The bot buys when price hits the bottom of the range (support) and sells when it rebounds to the top (resistance). After selling, it waits for price to fall back to support before buying again—repeating the cycle indefinitely.

For example, if Bitcoin ranges between $48,000 (support) and $52,000 (resistance), the bot buys at $48,000, sells at $52,000, then waits to buy again at $48,000. Each complete cycle captures the full range movement for profit. This works best in stable, ranging markets without strong trends.

When to use ping pong strategies

Ping pong bots are designed for sideways, consolidating markets where price oscillates predictably between support and resistance. Look for periods of low volatility after sharp moves when traders take profits and markets stabilize. Volume should be steady without extreme spikes indicating breakout potential.

Avoid using ping pong strategies during strong trends—if price breaks support or resistance decisively, the range is invalidated. Monitor for breakout signals like increasing volume, narrowing ranges, or fundamental catalysts. When trends emerge, pause the ping pong bot and switch to trend-following strategies.

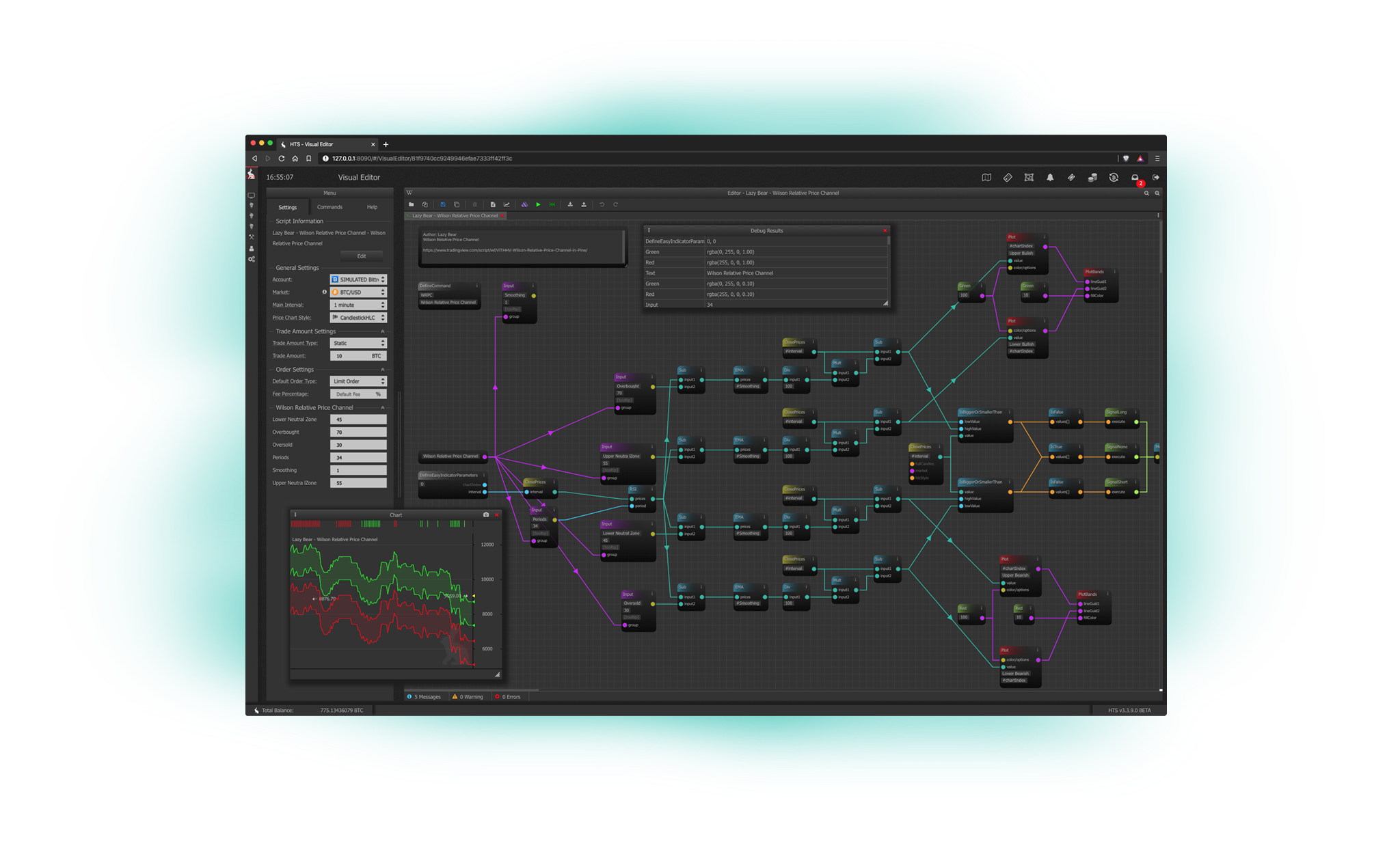

Fine-tune your ping pong bot

Set stop losses below support to limit damage from breakdowns. Configure profit targets slightly inside resistance to ensure fills (selling at $51,500 instead of $52,000 improves execution). Use percentage-based ranges that adapt to volatility rather than fixed price levels.

Combine with indicators like RSI to confirm oversold (buy) and overbought (sell) conditions within your range. Backtest different range widths to find optimal risk/reward ratios. Track win rates, average profit per cycle, and maximum drawdown to refine your configuration over time.

Frequently Asked Questions

Explore other bot strategies

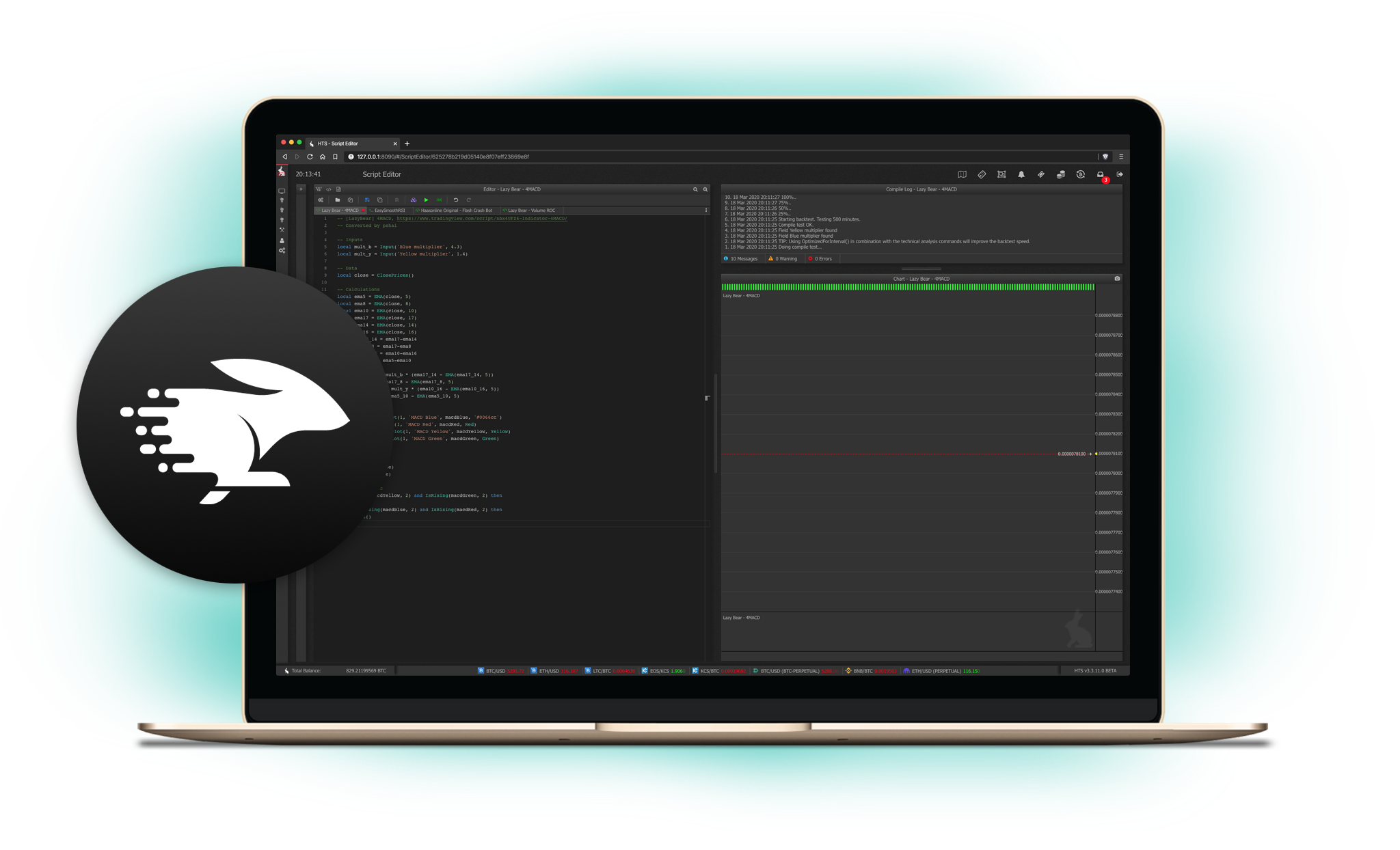

Automated Range Trading. Completely Free Trial. No Credit Card Required.

Profit from ranging markets with ping pong bots that automatically buy dips and sell rallies. Get a free 3-day trial with full access to all features. Start range trading in minutes.