Scalper Bot: High-Frequency Crypto Trading

Quick Profits

Capture gains from small price movements multiple times per day.

High Frequency

Execute dozens of trades daily to compound small gains into meaningful returns.

Limited Exposure

Short holding periods minimize directional risk from major market moves.

Market Neutral

Profit from volatility rather than price direction—works in both uptrends and downtrends.

Tight Stops

Small stop losses limit risk per trade while maintaining high win rates.

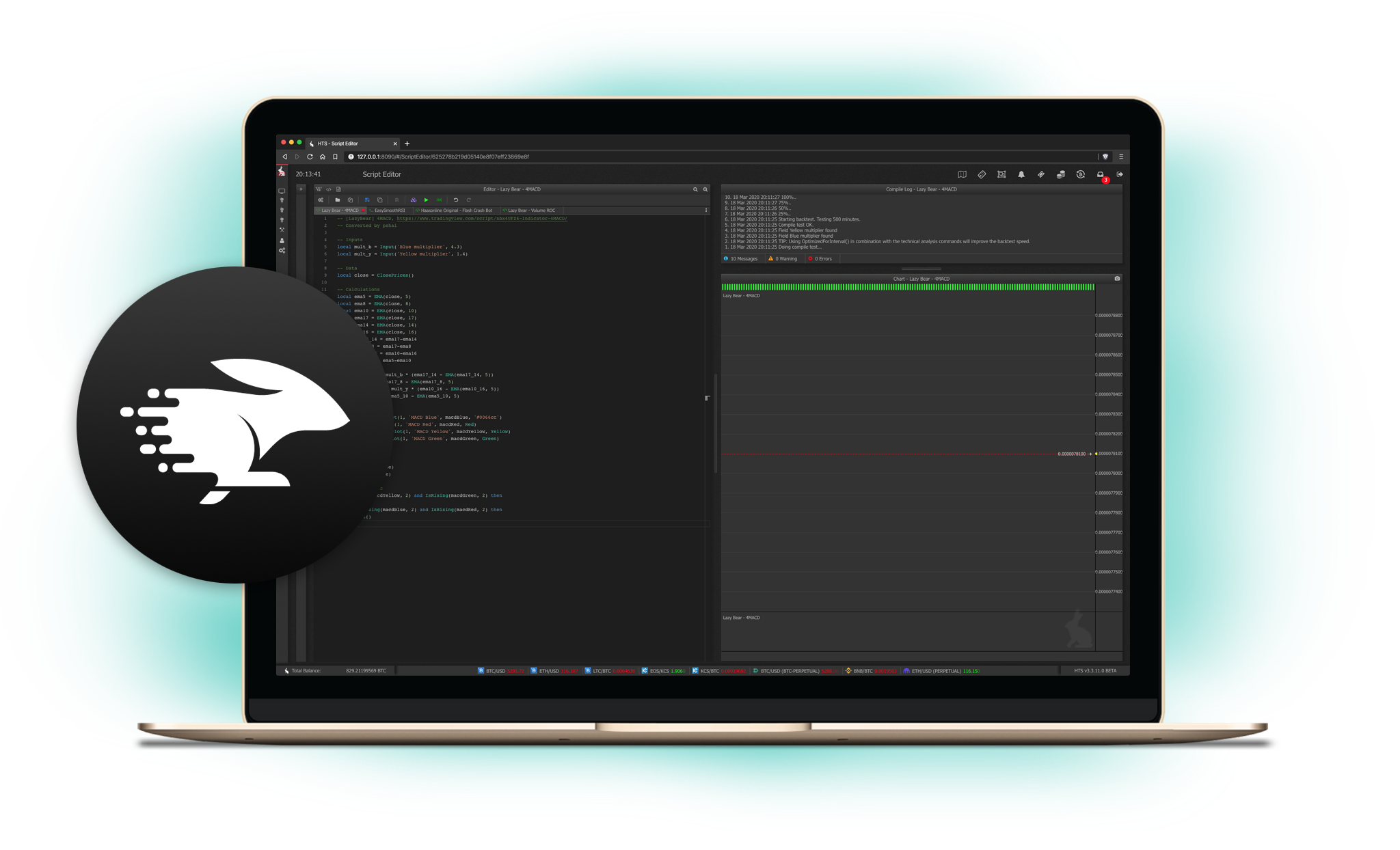

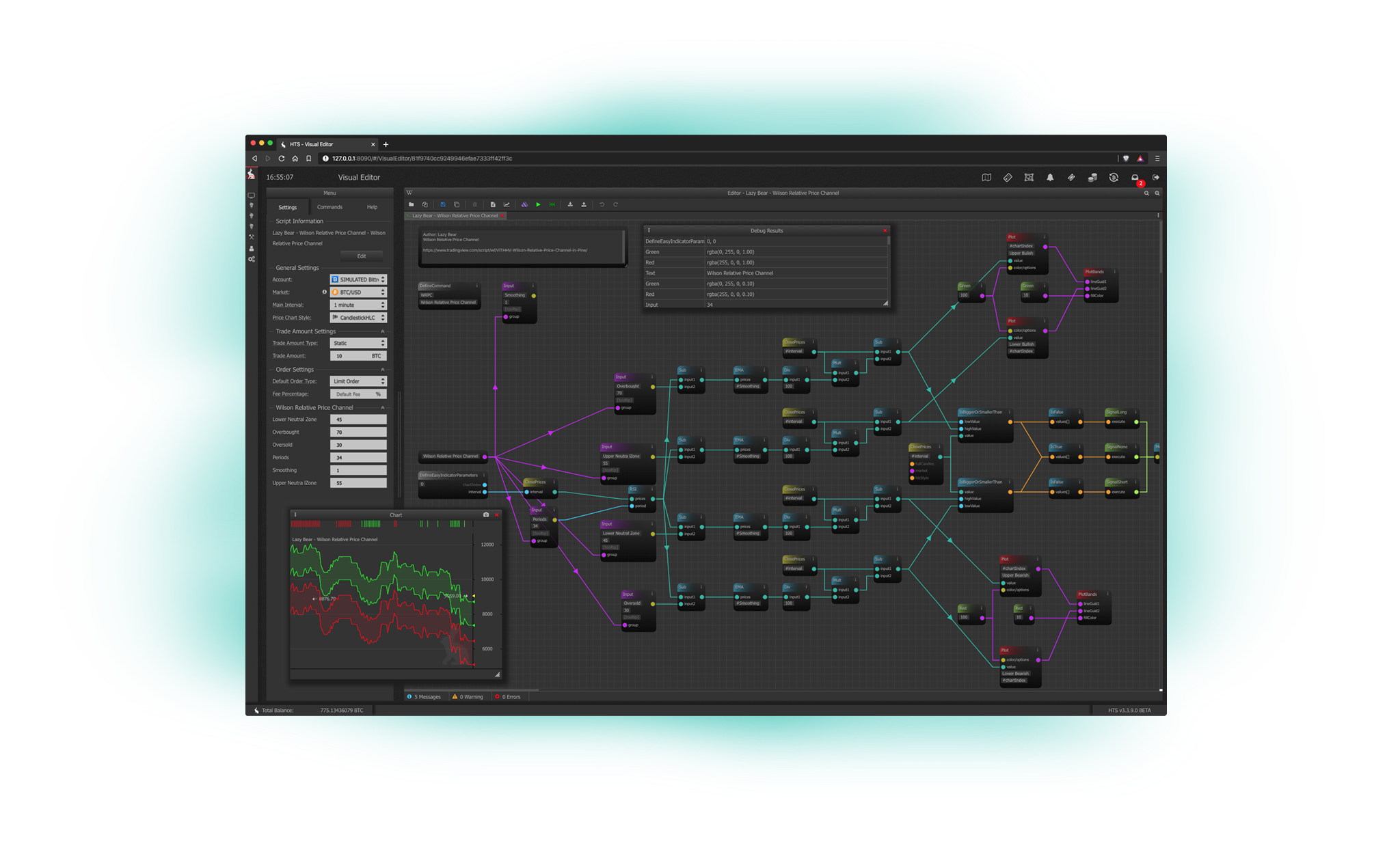

Automated Speed

Bots react instantly to opportunities humans would miss, maximizing scalping efficiency.

Many small wins add up

Scalper bots target 0.1-0.5% profit per trade with tight stop losses of 0.1-0.2%. A $10,000 position capturing 0.2% makes $20 per trade. Execute 20 successful scalps per day for $400 daily profit. Over a month, that's $12,000 profit on $10,000 capital (120% monthly return)—though actual results are typically lower due to losses and fees.

The strategy relies on high win rates (65-75%) and favorable risk/reward ratios. Speed is essential—enter when momentum appears, take profit quickly, and move to the next opportunity. Holding too long transforms scalps into swing trades with different risk profiles.

Identifying scalping opportunities

Scalpers use technical indicators like moving average crossovers, RSI divergences, volume spikes, or order book imbalances to identify short-term momentum. Look for quick price moves with strong volume—these suggest continued movement in the same direction for a scalp opportunity.

Bid-ask spread analysis reveals liquidity conditions. Tight spreads on liquid pairs enable fast entries and exits with minimal slippage. Wide spreads increase transaction costs and erode scalping profits. Some scalpers focus exclusively on major pairs (BTC/USDT, ETH/USDT) for optimal execution.

Protect capital with discipline

Strict risk management is non-negotiable for scalping. Use tight stop losses on every trade—if a scalp goes against you, exit immediately rather than hoping for recovery. Set maximum daily loss limits to prevent cascading losses during unfavorable conditions. Take regular breaks to avoid overtrading.

Fee management is critical since high trade frequency means fees compound quickly. On a 0.2% profit target with 0.1% fees per side (0.2% round trip), fees consume your entire profit. Use maker orders to earn rebates, negotiate lower fees for high volume, or focus on exchanges with favorable fee structures for active traders.

Frequently Asked Questions

Explore other bot strategies

High-Frequency Trading. Completely Free Trial. No Credit Card Required.

Start scalping crypto markets with automated bots that capture small profits dozens of times daily. Get a free 3-day trial with full access. Deploy scalping strategies in minutes.