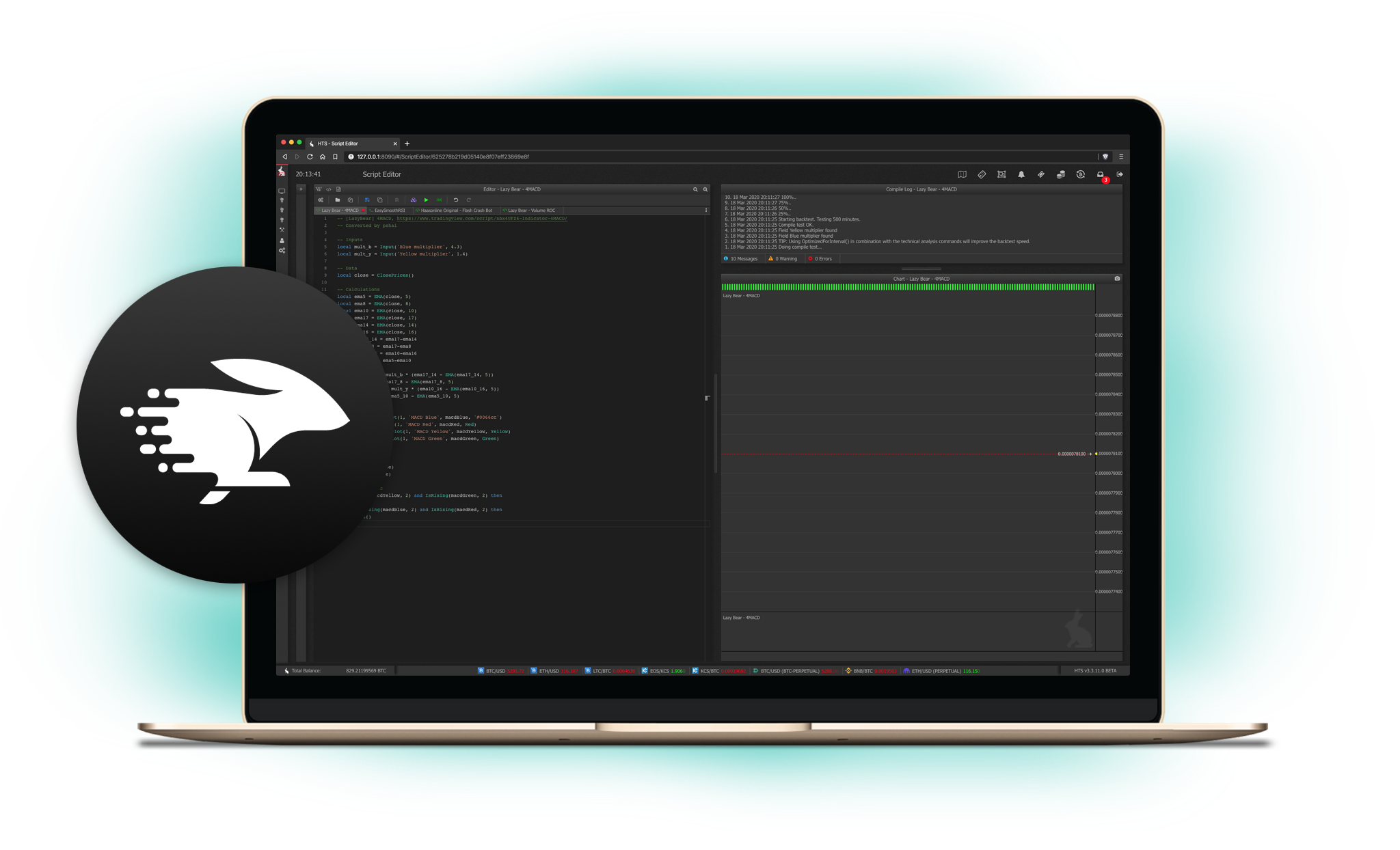

Signals Bot: Trade External Signals Automatically

Follow Experts

Automatically execute trades from professional traders and signal providers you trust.

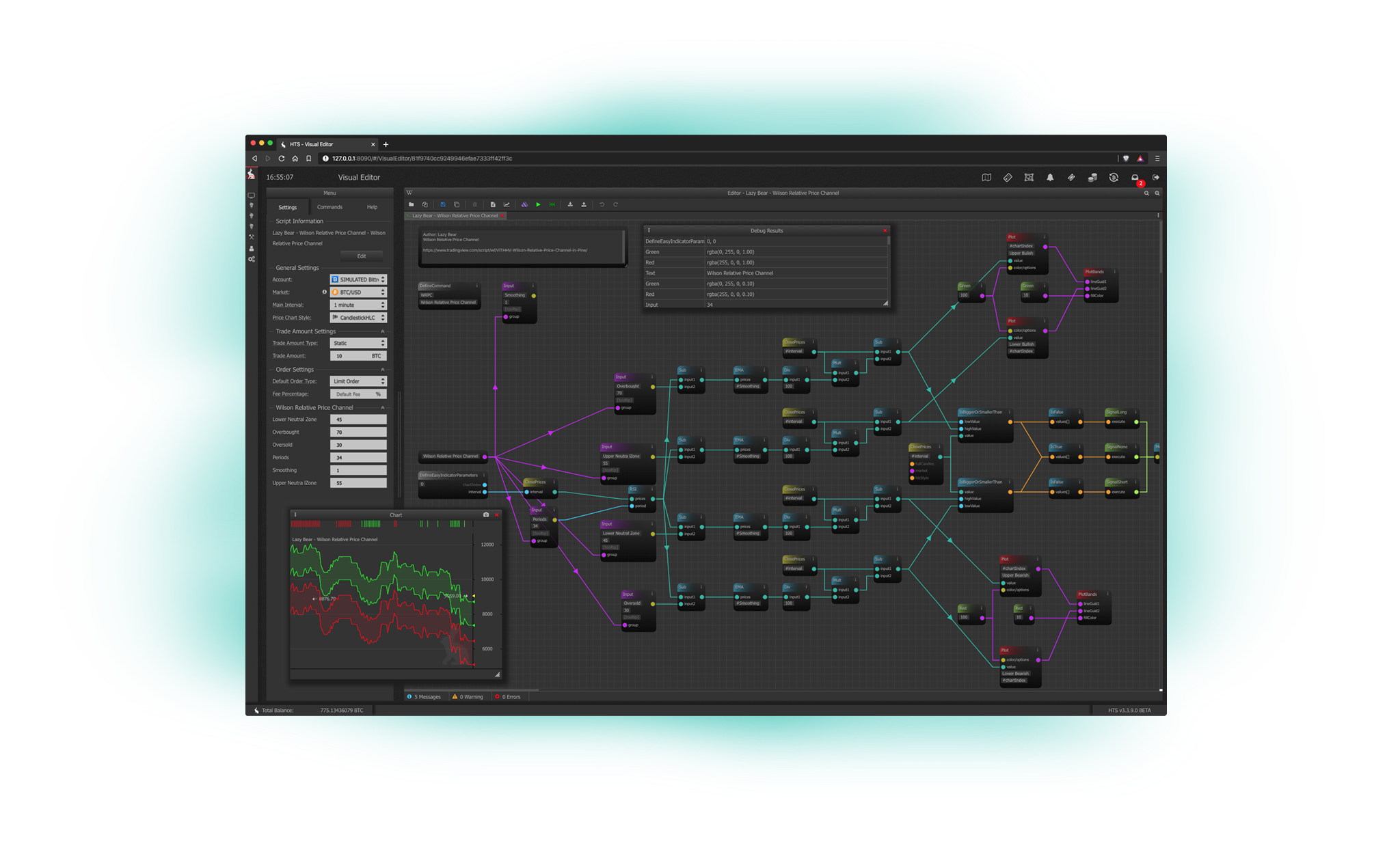

TradingView Integration

Connect TradingView alerts directly to your trading bot for instant automated execution.

Zero Delay

Execute signals instantly without manual intervention—speed matters in volatile markets.

Risk Management

Add your own stop losses, take profits, and position sizing rules to external signals.

Multiple Sources

Combine signals from various providers or filter based on confidence levels and conditions.

Backtesting

Test signal provider performance on historical data before committing real capital.

Execute expert analysis automatically

Signal providers analyze markets and send buy/sell recommendations via Telegram, Discord, TradingView, or webhook APIs. Your signals bot receives these alerts and executes trades immediately—buying when you get a "BUY BTC $50,000" signal and selling on "SELL BTC $52,000" alerts.

This separates analysis from execution. Expert traders focus on market research while bots handle order placement with perfect discipline. You benefit from professional analysis without needing extensive trading knowledge or constant market monitoring. The bot never misses signals, even while you sleep.

Multiple integration options

TradingView alerts trigger trades instantly when your technical analysis conditions are met. Telegram bots parse messages from premium signal channels. Discord webhooks receive signals from community analysts. Custom API endpoints allow integration with proprietary signal systems or machine learning models.

You can subscribe to multiple signal sources simultaneously and configure different strategies for each—aggressive position sizing for high-confidence signals, conservative sizing for speculative calls, or filters that require confirmation from multiple sources before executing.

Protect yourself from bad signals

Not all signals are profitable. Add your own risk management on top of external recommendations: maximum position size limits prevent overexposure, stop losses protect from large drawdowns, take-profit targets lock in gains, and daily loss limits prevent cascading losses from bad signal streaks.

Signal validation rules filter out unreliable alerts—require minimum confidence scores, verify price conditions before executing, or wait for confirmation from multiple sources. Track signal provider performance over time to identify which sources have better accuracy versus which produce losses.

Frequently Asked Questions

Explore other bot strategies

Automated Signal Trading. Completely Free Trial. No Credit Card Required.

Execute expert trading signals automatically with signals bots. Connect TradingView, Telegram, or custom webhooks. Get a free 3-day trial with full access to all features.